Let's Talk

Request a private consultation. Discover how you can Make Your Move™.

Business value is now more digital and intangible. Do you see the value that your buyer does?

Let’s spend ten years building a business and then let a purchaser enjoy the fruits of our labour, said no business owner ever. Whether you are selling or buying a business, you have to determine a price for it. Understanding the value of a business is a vital milestone in the mergers and acquisitions (“M&A”) process.

Business valuation estimates the true worth of a business so that you receive the value you deserve. Calculating the worth of a business is essential if you’re buying or selling, but that’s not the only reason. The value of a business is useful for a variety of reasons, including sale value, for financial reporting, taxation or in a shareholder dispute or divorce.

Simple as it sounds, the process of valuing a business can turn into a complex and contentious one. For example, a dissenting shareholder may want a higher value than what you think his stake is worth. That’s why it is useful to undertake an objective exercise. The purpose of valuation is to determine the present value of a business or asset. The process of valuation is to identify its sources of value. In a world where value is increasingly intangible, this can be easily overlooked or harder to understand and accept.

Case in point. Facebook famously paid USD19 billion for WhatsApp when the latter generates no significant revenues. If your business valuer is unable to value your business because it generates no revenues, you may not see what a purchaser sees. And in this case, you would have left USD19 billion of value on the table.

Here are some common reasons to perform a business valuation:

Buying/selling a business

Buyers often intend to pay the minimum price, while sellers want to sell for the maximum price. Parties often approach a business valuer for his professional assessment on business worth.

While most sellers may only have sold a company once or twice in their lifetime, buyers tend to have more experience purchasing other companies. Multinational companies, private equity or venture capital funds are major buyers. Thus, it is important to get an independent business valuation to set an expectation of what the business is worth and why.

Litigation/arbitration

During a court case, e.g. dissenting shareholders, divorce, or where is an issue with the value of a business, you will need to provide proof of the value of your business when dividing assets. The key is to convince the judge/arbitrator that the bases of value is sound rather than an inflated but unsupportable value.

Financial reporting

Fair value reporting is an important part of financial disclosure. Transparent, informative and accurate financial reporting are the lifeblood of the capital markets and are essential for investors to make informed decisions as to how to allocate their capital.

Valuation for tax purposes

Valuations conducted for tax purposes must consider specific nuances. This is vital in today’s environment, especially considering the scrutiny placed on transactions, including intercompany debt and transfers of entities and intangible property, all of which are heavily influenced by the fair market value of the subject interest.

It is crucial to integrate a valuation expert, in addition to a transfer pricing expert, as part of any tax structuring project. Insights from a tax valuation specialist can enhance the design, planning and implementation of a structuring project.

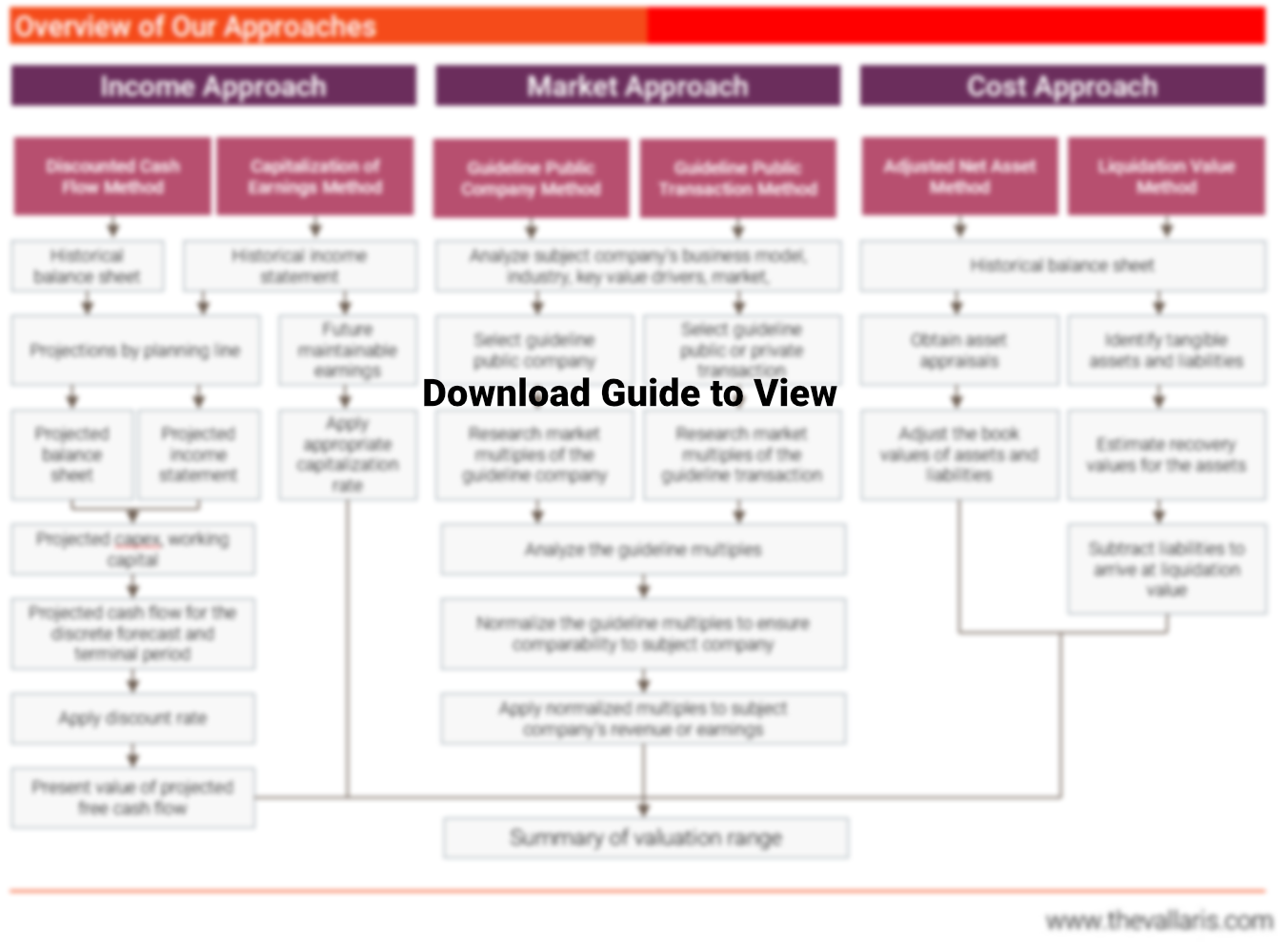

exhibit 1: business valuation approaches

The 3 commonly adopted approaches to value a business include:

The Market Approach is more common and popular. The Income Approach is the foundation on which all other valuation approaches are built. To do relative valuation, we need to forecast a level of earnings that represents what the business can sustain into the future. When we apply the Cost Approach to find out the carrying value of the assets and liabilities, we still go back to using Income Approach’s discounted cash flow for assets like intangible assets and financial assets.

Income approach

The Income Approach concerts a forecasted future benefit stream. Such as either cash flows or earnings, into a single number by discounting that benefit stream to present value using an appropriate discount rate.

Discounted cash flow measures an asset’s value as the present value of its expected cash flows. The resulting net present value (“NPV”) number is known as the asset’s intrinsic value. To estimate the intrinsic value correctly. The uncertainty of receiving those cash flows, otherwise known as risk, must also be described with an appropriate discount rate.

The Income Approach is useful for valuing firms:

The further we get from this ideal, the more difficult cash flow valuation becomes. Scenarios in which discounted cash flow valuation might be hard to apply and need to be adapted include the following:

Market approach

Relative valuation is also known as Market Approach. It evaluates businesses based on how similar businesses are currently market priced. There are two components to relative valuation. Prices have to be standardised by converting prices into multiples of book values. Another component is to find comparable guideline companies. It is difficult to do since every firm is unique. Firms in the same business can still differ based on different factors. Factors like their unique value proposition, geographical reach, capital structure, risk , growth potential and cash flows.

The Market Approach is very popular and widely used. Because a valuation based on a multiple and guideline public companies can be completed with far fewer explicit assumptions than a discounted cash flow valuation.

Relative valuations are easier to understand than a discounted cash flow valuation. This helps to ease the presentation to clients

A relative valuation measures relative rather than intrinsic value. Hence, it reflects the current mood of the market. In comparison to discounted cash flow valuations, relative valuation yields values much closer to the market price. This is particularly important to those whose job is to make judgements on a relative basis. And also to who are themselves judged on a relative basis. For example, fund managers are judged based on how their funds perform relative to other funds or a market benchmark. So, they are rewarded for outperforming a benchmark. Even if the benchmark itself is overvalued.

The strength of relative valuation is also its weakness. The ease relative valuations can be pulled together can result in inconsistencies. This is so if key variables such as business model, risk, growth or cash flow potential are ignored. The fact that multiples reflect market sentiment also implies that using relative valuation to estimate the value of business can result in values that are too high when the market is overvaluing comparable firms, or too low when it is undervaluing these firms. While there is scope for bias in any type of valuation, the lack of transparency regarding the underlying assumptions in relative valuation make them particularly vulnerable to manipulation. A biased valuer who is allowed to choose the multiple and associated guideline public companies on which the valuation is based can essentially ensure that almost any value can be justified.

Cost approach

The Cost Approach determines the value of a business based on the market value of its assets and liabilities. This is achieved by changing the stated or book values of a business ‘ assets and liabilities to their current market values.

The approach is appropriate when:

Conversely, if either Income or Market Approaches indicate a value that is higher than the value estimated using the Cost Approach, i.e. its NAV, the latter is typically dismissed in reaching concluding the value of the business. This is because the values estimated using either the Income or Market Approaches have incorporated the present value of a business’ growth opportunities. This contrasts with the Cost Approach, which only considers the business’ assets in place that are recorded on the balance sheet.

It must be highlighted that the use of the Cost Approach does not necessarily imply that the business is to be terminated or liquidated. Rather, the Cost Approach can be used for all premises of value. And it would include value-in-use as a going concern business.

The strength of the Cost Approach is that it is relatively quick to perform. For the most part, a valuer starts by analysing the business’ balance sheet to adjust the asset and liability carrying values to market values. However, this can become a complex exercise depending on which method is then chosen. For example, while the adjusted net asset method will conclude a business value for the company, it does not, unlike the asset accumulation method, identify the source of the business value. One can conclude from this observation that both Cost Approach methods are likely to arrive at very different estimates of business value.

Each of these 3 business valuation approaches can be further itemised into 6 commonly used business valuation methods:

exhibit 2: common valuation methods

Discounted cash flow (DCF) method

The DCF method estimates the equity value of a company by forecasting the cash flows. Then applying a discount rate to measure risks to those cash flows to arrive at a net present value (“NPV”)The discount rate applied should reflect the time value of money. And also risks associated with the cash flows as well.

The DCF Method comprises 5 key steps:

Capitalisation of earnings method

The capitalisation of Earning Method values a business based on the forecasted maintainable earnings. The earnings are generated by the company. These forecast maintainable earnings are divided by an appropriate capitalisation rate. So, to estimate the equity value of the business.In estimating maintainable earnings, earnings are typically adjusted for various items for comparability. Such as non-operating items, non-recurring items and discretionary items. These items may be at variance from the market level.

The applied capitalisation rate typically takes into account either business data for a single period of time, or an investor’s required rate of return as well as factor for future growth.

Guideline public company (GPC) method

The GPC method applies a market multiplier from market prices of comparable companies. It is for either the revenue or earnings of an unlisted company to estimate the latter’s equity value. The public companies identified for comparison should be similar to the subject company. Similar in terms of, inter alia, business model, industry, product lines. Unknown to many, market, growth, margins and risk can also include as well.

The share price of a public company is often reflective of trades in small blocks of shares. It would represent less than 50% of a public company’s equity. Its share price is typically reflective of a marketable, minority basis. If the subject company’s equity is not measured on a marketable, minority basis. Market multiples should be normalised before applied to a subject company’s revenue.

Guideline public transaction (GT) method

The GT method applies market multiples derived from actual transactions. This involves either minority or controlling interests in publicly traded companies. Or in closely held companies. Also, involve revenue or earnings of an unlisted company, so to estimate the latter’s equity value.In assessing a reasonable existence basis for comparison, the transaction should be similar. Access if the target company’s business model and whether the price paid is a distressed sale. The price paid by the target company was representative of an arm’s length transaction or a forced sale?

The market multiples may also need to be normalised. This is to ensure comparability to a subject company before applying. It will be applied to a subject company’s revenue or earnings. As the transactions may involve either minority or controlling interests. That can be in either publicly traded or closely held companies.

Adjusted net asset (ANA) method

In the ANA method, the book values of all assets and liabilities are adjusted to reflect fair value. There may be a need to identify and value intangible assets e.g. if a business delivers services to its customers over the Internet.

Liquidation value (LV) method

The LV method tells us how a company is worth by looking at its assets and liabilities. A recovery value estimated for its assets. These values are aggregated with the liabilities on the balance sheet. This method assumes that a business’ assets are sold off. Also, the proceeds are used to repay debt and other liabilities. The rest of the remaining is then distributed to shareholders.

The choice of approach considers a non-exhaustive list of factors that include:

exhibit 3: suitable valuation methods for different stages of a business’ life cycle

The valuation approaches and methods adopted depends on a business valuation engagement. It is at the discretion of the valuer. That is based on factors associated with the specific engagement. These include:

Standard of value

Standard of value refers to the identification of the type of value. It is from the utilising of this value in a specific engagement. The purpose of a valuation could be for a transaction, financial reporting and more. Once this is established, the appropriate standard of value can be applied. According to the International Valuation Standards (“IVS”), these include:

Premise of value

This refers to the highest and best use of a business. There are two key distinctions to consider for a business. Whether the business should be valued as a going concern such as continuing to operate in business. Or, if in liquidation (i.e., the business is worth more dead than alive). The best use concept is to determine which premise would provide the greatest sum value.

How a business generates value

If a business generates cash flow from operations, We would focus on the P&L statement. It serves as a starting point to conduct the valuation exercise. This would mean the adoption of either the Income Approach or Market Approach. If a business generates value from its assets, we would turn our attention to the balance sheet. Value from assets includes real estate, metal oil and gas, etc. This, in turn, leads us to the Cost Approach.

Business life cycle

The stage of the business life cycle will impact the choice of valuation method which can be adopted. For example, it would not be reasonable to apply the Market Approach to startups. This is because start-ups may not generate a profit. Even if they do, it would not be reasonable. Incomparable to apply listed comparable financial multiples to the book values of startups. As listed companies have a very different business risk profile from startups.

Stand-alone or synergistic value

When a company acquires another, the transaction will create revenue or cost synergies. Sometimes, it is both revenue and cost synergies. The synergy is the presumption that the target firm controls a specialized resource. This value is unleashed when the two firms join forces. This becomes an increasingly important differentiator in deal strategy. A business valuer who can identify under-utilized assets of a target. This may be of great value to a potential acquirer. It can dramatically increase the synergistic value of the target.

Availability of information

All valuation exercises need inputs. But, most clients are able to furnish audited financial statements. Or could they provide management accounts, some companies do not produce financial forecasts. This makes it impossible to adopt the Income Approach’s Discounted Cash Flow Method. That’s needed to conduct the valuation.

exhibit 4: information required for different valuation methods

As a buyer

There are many reasons why an investor or entity may be looking to merger and acquire businesses. Whether it is for investment, or strengthening a company’s capabilities. Maybe to transact to gaining access to new markets. .

Not all dealmakers can maintain a level head and avoid getting caught up in a bidding frenzy. Only to suffer a victory at a great cost. An expert can provide greater insights into the intrinsic valuation of the target. We are aware of the synergistic values of these targets. This value can be unlocked once integrated into your business. And it is especially critical if an acquirer can envision and unlock value. In the case where others cannot, they are better able to submit a winning bid.

As a seller

In the deal space, buyers tend to be more experienced in purchasing businesses. Vendors in comparison are less experienced. Many vendors will ask their valuer what the standalone worth of business is. As they are unable to see the true value of their business. Likely that this approach may result in the vendor leaving money on the table. We understand how buyers can capture potential future business value. Through either re-positioning or synergistic gain. This allows vendors to unlock the true intrinsic value of their business. VALLARIS also advises vendors how to address key issues and concerns.

In any high stakes’ transaction, you would want to hire an accredited valuer, e.g. a Chartered Valuer and Appraiser (“CVA”). These are Institute of Valuers and Appraisers of Singapore (“IVAS”) accredited experts trained to guide you through the valuation for an important fundraising exercise. Should the matter go to court, a business valuer’s track record advising in lawsuits or deals needs to be accounted for. The added legitimacy from his skills and work quality gives confidence to the client.

The sting of pricing wrong when selling or buying a business can hurt for a long time.

Request a meeting with VALLARIS.