Lets Talk

Request a private consultation. Discover how you can Make Your Move™.

Issues to watch during asset impairment testing.

The giveaway guide to save hours of stress on your asset impairment testing exercise.

DownloadImpairment is an accounting term.

It relates to a permanent reduction in the value of a company’s asset or cash-generating unit (“CGU”), typically a fixed asset or an intangible asset.

To test for asset impairment, we compare the recoverable amount with the current carrying amount. If the carrying amount of the asset exceeds the recoverable amount, the difference is written off as an impairment expense and the value of the asset declines on the company’s balance sheet. Following are some terms that are commonly misunderstood:

Cash-generating unit

A cash-generating unit is the smallest identifiable group of assets that generates cash inflows that are largely independent of the cash inflows from other assets or groups of assets.

Carrying amount

Carrying amount is the amount at which an asset is recognised after deducting any accumulated depreciation (amortisation) and accumulated impairment losses thereon.

Recoverable amount

The recoverable amount of an asset or a cash-generating unit is the higher of its:

Fair value (“FV”):

Fair value is the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date.

Value in use (“VIU”)

Value in use is the present value of the future cash flows expected to be derived from an asset or cash-generating unit.

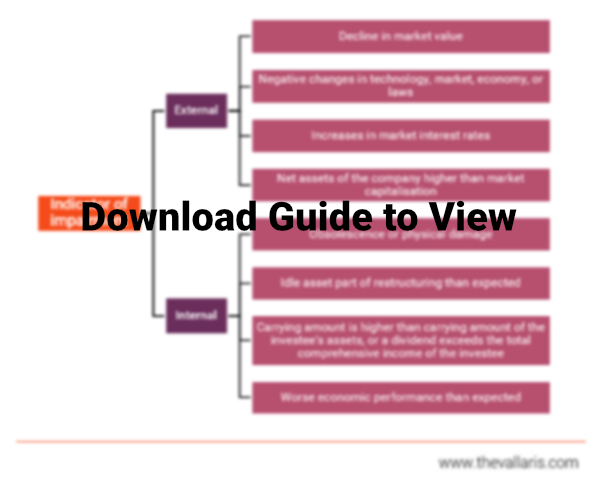

FRS 36:12 provides some guidance on external and internal indicators of impairment.

exhibit 1: indicators of impairment

External indicators of impairment

Internal indicators of impairment

Certain event-triggering thresholds are easy to define and recognize. For instance, a business should test for impairment when accumulated costs are in excess of amounts originally expected to construct or acquire an asset. In other words, it is more expensive than once thought to obtain a business asset.

Other triggering events are correlative. An asset might be associated with a history of current period losses or operating cash flow losses. Perhaps the asset shows a pattern of declining market value.

There are also triggering events that are vague but create uncertainty. Adverse changes in legal factors or general economic conditions are both grounds for testing an impaired asset despite a broad range of possible interpretations for adversity. Covid-19 pandemic is an example.

Assets not subject to impairment testing under FRS 36:

Assets subject to impairment testing under FRS 36:

Two financial statements are impacted when taking an asset impairment loss. The asset impairment loss on income statement is reported in the same section as operating income and expenses. An impairment loss ultimately reduces the profit for the period, but it has no immediate impact on the company’s cash balance. The company also writes down the asset’s carrying value that is reported on the balance sheet to the recoverable amount.

In other words, the carrying value is reduced by the asset impairment loss. Going forward, the company adjusts the amount of annual depreciation because prior depreciation expense was based off the asset’s old carrying value.

Enterprise, total asset or equity value?

The first step in impairment testing of goodwill is to compare the fair value of a reporting unit to carrying value. However, should the value basis be determined at the enterprise, total asset or equity level?

Enterprise value testing is straightforward and involves no significant disadvantages. Enterprise value also reflects the fair value of debt and equity. Another advantage is that market-derived information is often available. In fact, enterprise value multiples are often provided through publicly available information.

Total asset value testing involves comparing the carrying value of total assets with their fair value. Just looking at the left side of the balance sheet is an advantage over enterprise-level testing, but there are drawbacks too. Unlike enterprise value, calculating total assets is not a single-step process. We first have to calculate an enterprise value and then add debt-free liabilities and adjust for deferred taxes. Another drawback is market transactions are typically not reported in terms of a total asset purchase price, so relevant market multiples may not exist.

Equity-level testing, the third approach, appears simple. If the equity market value is greater than the carrying value of equity, then impairment may not be indicated. Conversely, if the carrying value is higher, impairment may be indicated. But in practice, this approach is problematic because enterprise value less debt may not yield a meaningful equity value. The element of debt to be subtracted is subjective, be it fair value, book value or current obligations. In addition, in some instances a company or reporting unit may show negative equity, which could suggest no impairment, when in fact, at an enterprise level impairment is indicated. In our experience, auditors will often ask for re-testing at a different level if equity level testing is initially selected.

Discount rate and valuation methodologies

It is challenging to determine an appropriate discount rate for cost-of-capital purposes given current sentiments. The current risk-free rates are “abnormally” low as a result of quantitative easing measures. There is no consistency across house views in whether to apply a historically low current rate or a normalized rate. What is an appropriate capital structure? In our view, it is best to take a market-participant perspective.

Equity risk premiums have also changed — historically yielding a 5 to 7 percent range, while current empirical data reports about 5.2 percent.

Size premiums and non-systematic risk premiums are also important. In practice, it is critical to support the assumptions selected. This is equally true for the approaches (cost, market or income) used for fair value calculations. Auditors scrutinise the selection of the fair value methods employed and the weight applied to each.

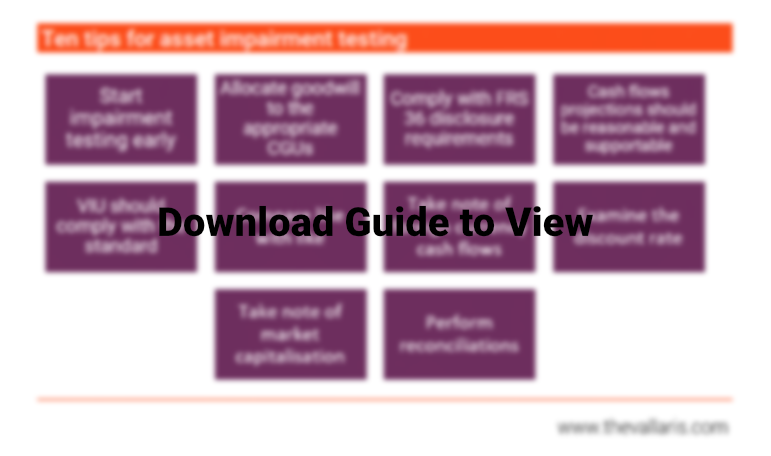

exhibit 2: ten tips for asset impairment testing

Tip 1: start impairment testing early

The impairment testing process should begin early. It takes time to identify impairment indicators, assess future cash flows, determine discount rates, test reasonableness of the underlying assumptions and benchmark these assumptions with the market.

In the case of goodwill, goodwill does not have to be tested for impairment at the year-end; it can be tested earlier. However, if any impairment indicator arises between the date of the test and the balance sheet date, the impairment assessment should be updated.

Tip 2 – allocate goodwill to the appropriate CGUs

Goodwill does not generate cash flows independently from other assets or groups of assets, so the recoverable amount of goodwill as an individual asset cannot be determined. However, goodwill often contributes to the cash flows of an individual or multiple CGUs. Therefore, goodwill acquired in a business combination is allocated from the acquisition date to each of the acquirer’s CGUs or groups of CGUs that are expected to benefit from the synergies of the business combination. Determining the recoverable amount of the goodwill then becomes part of determining the recoverable amount of the CGU or CGUs to which it has been allocated. It is important to think about how the goodwill is going to be subsequently tested for impairment before finalising the allocation process.

Tip 3 – comply with FRS 36 disclosure requirements

Common omissions in impairment disclosures that are required by FRS 36:

FRS 36:134(d)

If the recoverable amount is based on value in use, an entity shall disclose:

In addition, management should devote attention to sensitivity analysis. Notwithstanding that values assigned to key assumptions may be regarded as sensitive, but there are no disclosure exemptions.

FRS 36:134(f)

Tip 4 – cash flows projections should be reasonable and supportable

Forecasts prepared previously (for example, before the full effects of an economic downturn became clear) should be revisited, and revised if necessary. A forecast should be prepared using reasonable and supportable assumptions that represent management’s best estimate of the economic circumstances that will prevail over the remaining life of the asset or CGU.

Management should take into account external evidence. For example, the cash flows/forecasts should be compared with analysts’ forecasts for the sector and the views of other third-party experts. Management should provide explanations when there are inconsistencies.

Tip 5 – VIU should comply with the standard

In calculating VIU, future cash flows should be estimated for assets based on current condition. Limitations relate to assuming:

The costs and benefits of a future restructuring/ reorganisation should be excluded from the cash flow forecasts, unless the entity demonstrates commitment and makes the relevant provisions. The costs and benefits of future capital expenditure that is intended to improve or enhance the assets should also be excluded.

Tip 6 – compare like with like

The cash flows that are tested should be consistent with the assets being tested. There should be consistency when working capital is included or excluded from the CGU. The forecast cash flows should also factor in investment in working capital if the business is expected to grow.

In principle, under FRS 36, cash flows relating to assets that generate cash flows independently of other assets are excluded from the forecasts (because they are also excluded from the carrying amount of a CGU). Examples include financial assets such as receivables.

Similarly, cash outflows relating to obligations that have already been recognised as liabilities are excluded, as the related liability is excluded from the CGU. This ensures that like is compared with like. Examples of such liabilities include payables, pensions and provisions.

Cash flows should exclude cash flows relating to financing (which include interest payments), as liabilities are excluded from the carrying amount and because the cost of capital is taken into account by discounting the cash flows.

Many entities preparing cash flow forecasts for the purposes of impairment testing base the forecasts on the underlying cash flow forecasts for the business. These include cash flows from the settlement of working capital balances at the year end. FRS 36 permits these entities to leave the forecasts unadjusted, as long as the carrying value of the CGU is increased by the amount of the working capital assets and reduced by the value of the working capital liabilities.

Tip 7 – take note of foreign currency cash flows

Foreign currency cash flows are common and are required to be dealt with in a specific way by FRS 36. They add complexity to the discount rate. The future cash flows are estimated in the currency to be generated and then discounted at an appropriate rate for that currency. This discount rate may not be easy to determine. It is likely to be different from the rate used for the remaining present value calculation, because it is country- and currency-specific.

The present value of the foreign currency cash flows should be translated at the spot date at the date of impairment testing. A more reliable estimate of future exchange rates than the current rate cannot be used. FRS 36 prohibits use of a forward rate that exists at the date of the impairment testing.

Tip 8 – examine the discount rate

Examine the logic in arriving at discount rates. Risk-free interest rates set by central banks are falling in many territories, but other factors affect discount rates. These include corporate lending rates, cost of capital and risks associated with cash flows, which increase in a volatile environment, resulting in an increase in the discount rate.

Many companies use the capital asset pricing model (“CAPM”) to determine the discount rate. Given current market condition, several CAPM inputs will have changed. For example, with many national base rates reduced, the risk-free rate of government bonds will have fallen in many territories. However, this may be offset by increase in other inputs, such as equity risk premiums.

Tip 9 – take note of market capitalisation

If the entity is a public listed company, market capitalisation is an external data point to be considered to reconcile with cashflows forecast. FRS 36:12(d) states that an explicit trigger for an impairment test is when market capitalisation is below net asset value. Calculations of recoverable amount are required. If the market capitalisation is lower than a VIU calculation, the appropriateness of the assumptions would be challenged.

Tip 10 – perform reconciliations

We reconcile the conclusion with the current environment as a cross-check.

The economic climate assumptions that were reasonable a year ago are possibly no longer reasonable. For example, a lack of credit standing would result in many planned investments being cut back, impacting on growth prospects.

Consumer confidence is falling as the economic outlook deteriorates, and consumer spending is impacted. Reduced spending is affecting many industries, not just banking and property. Cash flow growth assumptions should therefore be reviewed carefully and compared to up-to-date economic growth forecasts.

It is possible to obtain analyst reports for most market sectors. These should be considered as evidence to support growth assumptions. It would also be worth reviewing comparable deals and multiples implied in these deals versus the implied multiples and valuations inherent in any impairment test discounted cash flow calculations.

Your business has not suffered an impairment but persuading your auditor otherwise is taking away too much time from running your business?

Request a meeting with VALLARIS.