Let's Talk

Request a private consultation. Discover how you can Make Your Move™.

Accountants understate intangible asset value.

The giveaway guide to identify, value and monetize intangible asset value.

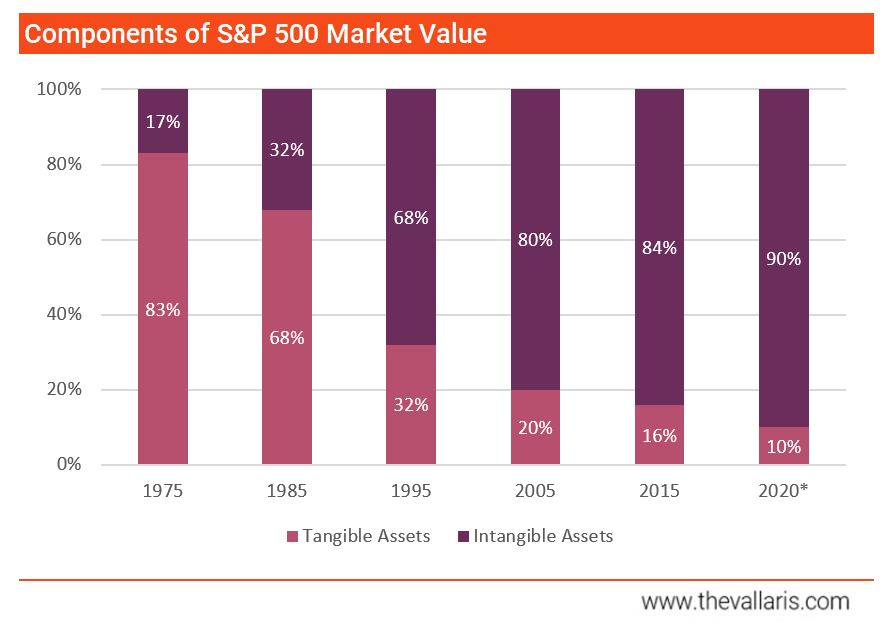

DownloadList the physical assets owned by all companies on the Standards & Poor’s 500 (“S&P 500”). Sell their factories, office buildings, equipment, vehicles and inventory at cost. Net sales would not even exceed 10% of the index’s USD28 trillion value.

exhibit 1: components of s&p 500 market value

What then are the new crucial but invisible drivers of business value? Intangible assets. Identifiable, non-monetary assets that lack physical substance. An intangible asset can be thought of as an asset that brings value to a business but cannot be seen nor felt.

Intangibles used to play a much smaller role than they do now, with physical assets comprising the majority value for most businesses. However, an increasingly competitive and digital economy has placed the focus on intangible assets, as companies race to out-innovate one another. Over the last 35 years, intangible assets have emerged as the leading driver of business value. Their growth now accounts for 90% of S&P 500’s market value.

exhibit 2: intangible asset types

Intangible assets are one of three types of assets recognized on a balance sheet. The other two are tangible assets and financial assets. Tangible assets include physical property such as real estate, equipment and inventory. Financial assets are non-physical assets whose value is derived from a contractual claim, such as cash, shares and bonds.

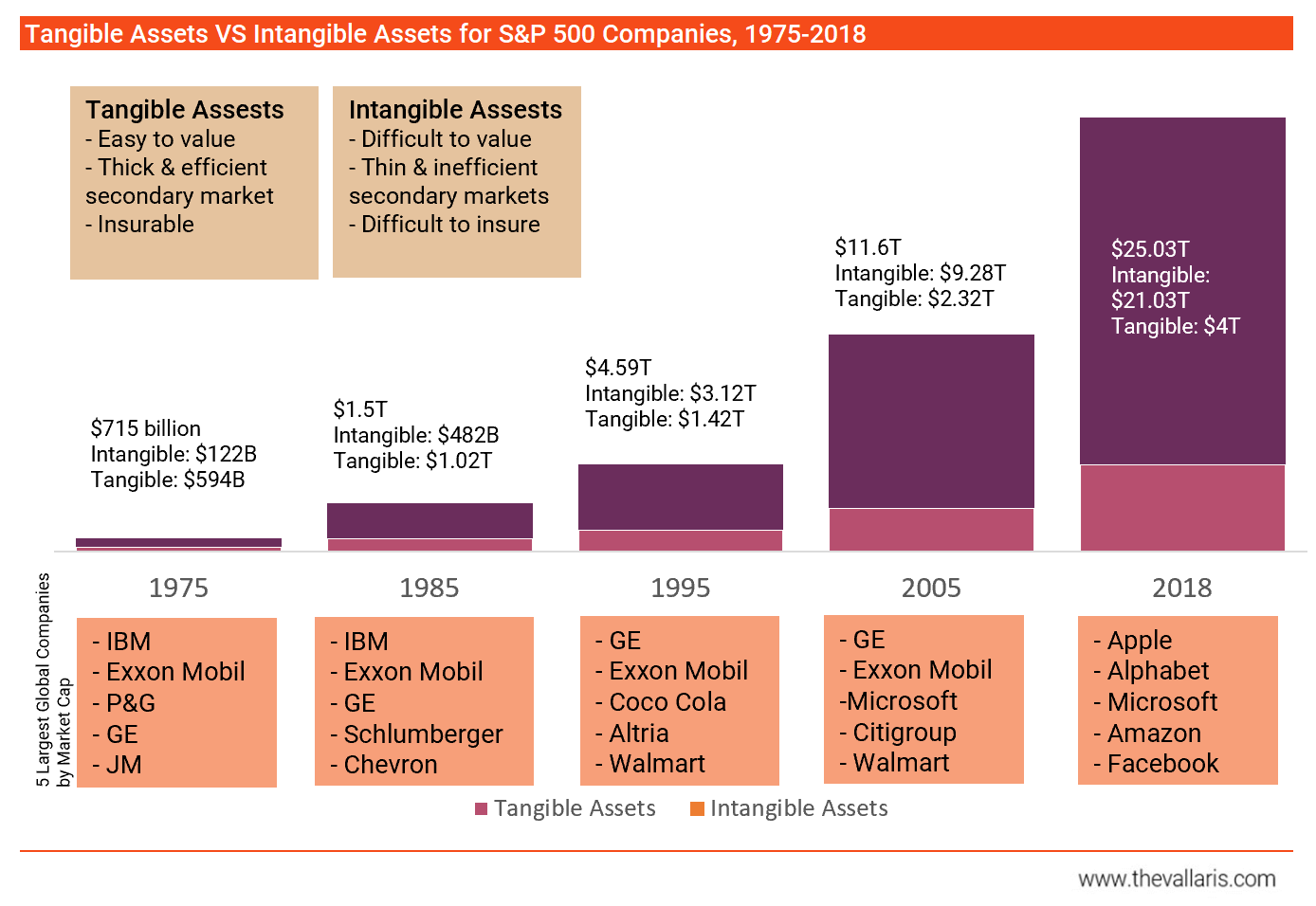

exhibit 3: s&p 500 companies’ tangible assets vs intangible assets

Intangible assets can be hard to value. Unlike tangible assets, they do not always have a purchase value. For example, a business may have built its brand strength over time rather than purchased it for a fee.

It therefore isn’t always possible to calculate the initial cost of an intangible asset. This means that many intangible assets created by a business cannot be reported on a balance sheet. Not understanding the value of intangible assets may mean that you leave a large amount of value on the table when selling your business without even knowing it.

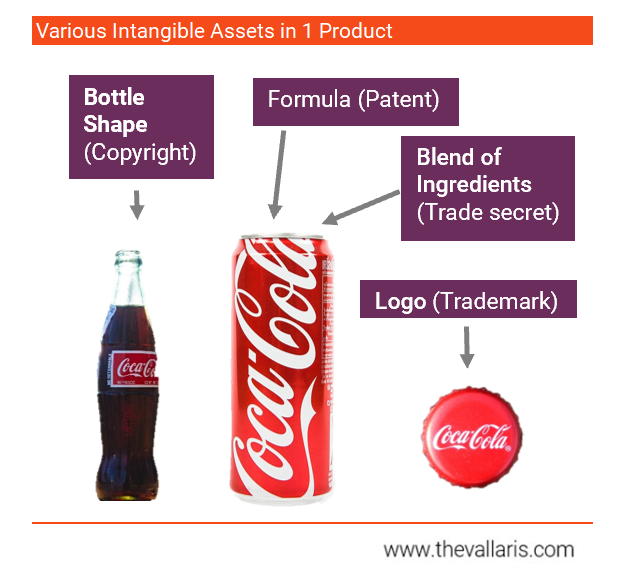

A useful way to identify intangible assets around us is to change the words we use. Instead of speaking of goods and services, we could speak of tangibles vs intangibles. Regardless of whether you are selling a product or service, you are really selling an intangible service. The usefulness of this distinction becomes apparent if we illustrate with an example. It can be argued that coffee beans are free since they grow wild in nature. However, someone was paid to provide the following value-added services: harvest the beans, ship them to a processing plant, roast and package the beans, design the hardware and consumables to deliver to you freshness and convenience at an affordable price. Therefore, one way to view the price paid for a tangible cup of coffee is actually a fee paid to coordinate a stack of invisible, value-adding services to deliver the experience of drinking a satisfying, café grade cup of java in the comfort of your home. These ‘invisible’ services can be translated into intangible assets that enhance the customer experience. A brand’s promises, being intangible, has be “tangibalized” in their presentation of goods and services to you, the consumer.

exhibit 4: four intangible assets in one product

Accounting standards do not allow a business to recognize internally-generated intangible assets (with some exceptions). This means that any intangible assets listed on a balance sheet were purchased as part of a business combination or as individual assets.

If a company conducts extensive research for many years and eventually creates a valuable patent, the accounting rules instruct that costs are to be expensed as incurred. No intangible asset can be capitalized. This means that the company cannot recognise the patent as an asset. However, if the same company were to buy instead of build the patent, it may record the patent on its balance sheet at fair value.

One effect of this accounting treatment is that many companies that have spent large amounts of cash over the years to develop valuable intangible assets are unable to capitalize the relevant costs. As a result, their balance sheets does not identify the true worth of their intangible assets. This can be misleading when an outsider attempts to understand of the value of a business by relying on its financial statements.

Though intangibles do not appear on the balance sheet in many instances, this can also work in favor of a company. First, the entity does not have to absorb an ongoing amortization charge to reflect the ongoing consumption of the value of these assets, since the entire cost was charged to expense up front. Also, the accounting standards state that a sudden loss in the value of an asset can trigger an impairment charge, which can adversely impact profits. Again, since the cost of these assets was written off up front, the organization has no intangible assets that could be subject to such a charge.

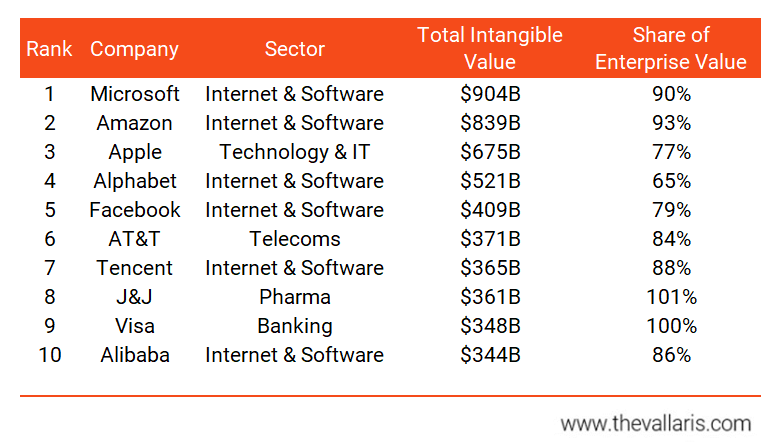

Brand Finance, which produces an annual ranking of companies based on intangible value, has companies in these sectors taking the top five spots on the 2019 edition of their report[1].

exhibit 5: companies ranked by intangible assets

It’s important to note that Brand Finance’s ranking is based on both disclosed intangibles—those that are reported on a company’s balance sheet—and undisclosed intangibles. In the ranking, undisclosed intangibles were calculated as the difference between a company’s market value and book value.

Internet & software

The growth of the Internet has had a huge impact on the software industry, from the ease of creating new businesses to the processes that companies use to develop, distribute, and support their products. Traditional desktop and client-server applications in the software industry are centralized. The internet today is largely decentralized. The internet of things (“IOT”) introduces a complex combination of hardware and software that must work together flawlessly in a wide variety of environments and in many cases with no human interaction. Cloud computing and edge computing techniques enable users to maximize productivity, fix problems remotely and before they become an issue and reduce switching costs to zero.

Technology and IT

The technology industry predated the rise of the Internet industry. Stalwarts Microsoft, Apple and IBM sold computer services in the form of hardware and software divided across three sectors: mass-market software vendors, enterprise software vendors, and computer services. The three sectors were distinct, because personal computers, corporate mainframes, and online computer networks operated in relative isolation. The arrival of the Internet effectively connected everything, facilitating the entry of mass-market vendors into enterprise software and of both mass-market and enterprise software vendors into computer services. As the turbulence of the first decade of the Internet era subsides, a gradual transition from traditional software products to “Web services” is taking place.

Healthcare

Today, all industries use the internet to communicate, record, supply, operate and develop products and services throughout the world. In the medical field, the internet has enabled a multitude of innovations that revolutionized the way physicians provide patient care. Electronic medical records and the exchange of patient files over the internet have made caring for patients more accurate and more effective. It has also reduced costs because it eliminates the need for re-testing for diagnosis, when recent results are available through digitally stored files. The internet also allows medical professionals to communicate with patients on a more frequent basis in a timely and convenient way. They can provide information on new vaccines, medications and treatments that can help improve public health and manage medical conditions more effectively. This information can help to ensure closer contact with physicians and better outcomes for patients. For example, an outbreak of infectious disease in a community can be reported on a wide basis, informing residents of the availability of vaccines, early symptoms and treatments that can help to save lives.

Entertainment

In the past a consumer had to fit his schedule around a TV/cinema screening timetable. The tables have turned. Entertainment services providers now have to deliver content on demand and work around a consumer’s timetable. Consumers have increasingly migrated from linear programming, e.g. cable TV, to live streaming, pay-for-services video providers, e.g. Netflix, Hulu, etc. Consumers now have the choice to get and pay for only what they want in the way of entertainment, whether that be music, live shows, or TV programming. This presents a huge challenge for traditional cable and satellite companies that continue to only offer packages of TV channels that subscribers don’t want. Telecom companies have to leverage intangible assets to look for new ways to engage their customer base and offer more flexible, personalized ‘package’ deals. Connected TVs and voice technology will continue to rise. Consumers want to be able to say, “Play episode one of The Crown and get it delivered immediately by Google Assistant, connected to the Google Chromecast.

Intangible assets are recorded at their acquisition date fair value. If the intangible asset is determined to have a useful life, i.e. more than one year, then its value is amortized over that useful life. If at any point there is judged to be a decline in the remaining value of an intangible asset below its carrying amount, then the difference is recognized as an impairment expense in the current period; that is, the impairment charge is not spread out over a number of periods.

In order to have value, intangible assets should generate some measurable amount of economic benefit to the owner, such as incremental revenues or earnings (pricing, volume, and better delivery, among others), cost savings (process economies and marketing cost savings), and increased market share or visibility. Owners exploit intangibles either in their own business (direct use) or through a license fee or royalty (indirect use).

Relevant question to ask to estimate an intangible asset value include:

VALLARIS believes that a business should record and value its intangible assets, including key assumptions made in estimating their value. This information is useful to employees, investors and other stakeholders. In fact, 95% of institutional investors agree that intangible assets contain information crucial to assessing the future strength of a company’s business model[2].

Three of the more common methods to value intangible assets include:

exhibit 5: intangible asset valuation approaches

Relief from royalty method (RRM)

The RRM calculates value based on a hypothetical stream of royalty payments that would be saved by owning the asset rather than licensing it. The rationale behind the RRM is simple: Owning an intangible asset means a business doesn’t have to pay to use the asset. The RRM is often used to value intangible assets whose revenue can be derived from royalty and license fees e.g. trademarks, tradenames, franchises, software, copyrights, etc. Estimating value using the RRM involves the following steps:

1. Forecast financials: Forecast a business’s financials, including revenue, expenses, capital expenditure, growth rates, and tax rates. Management provides this forecast;

2. Estimate royalty rate: Estimate a suitable royalty rate for the intangible asset based on an analysis of royalty rates from publicly available information for similar domain names and of the industry in question. Royalty rate information is available from paid databases, or statutory filings of similar publicly traded companies.

3. Estimate useful life: Estimate the useful life of the asset to understand how long intangible asset related cash flows are likely to persist.

4. Apply Discount Rate: Convert the stream of after-tax royalty savings to a present value lump sum amount.

The RRM contains assumptions from both the market (royalty rate) and income approach (estimates for the financial forecast and discount rate).

Multiperiod excess earnings method (MPEEM)

The MPEEM is a variation of discounted cash-flow analysis. Rather than focusing on the whole entity, the MPEEM isolates the cash flows that can be associated with a single intangible asset and measures fair value by discounting them to present value. The MPEEM tends to be applied when one intangible asset is the primary driver of a firm’s value and the related cash flows can be isolated from the firm’s overall cash flows. Customer contracts and customer relationships are among the sorts of assets that frequently generate such cash flows and could be assessed with fair value measurement using the MPEEM. The MPEEM usually involves the following steps:

1. Forecast Cash Flow: Forecast a business’s financials, including revenue, expenses, capital expenditure, growth rates, and tax rates. Management provides this forecast. Estimate the after-tax cash flows;

2. Estimate Economic Rent: Deduct hypothetical economic rent from contributory assets that were used to deliver the value promised in the intangible asset. For example, we could have had to rent a machine in order to create a widget ordered under a customer contract. This is also known as a contributory asset charge (“CAC”).

3. Estimate Useful Life: Estimate the useful life of the asset to understand how long intangible asset related cash flows are likely to persist.

4. Apply Discount Rate: Convert the stream of excess cash flows to a present value lump sum amount.

Assessing the CAC can be a challenge with MPEEM. The required returns on CAC must be consistent with an assessment of the risk of individual asset classes and should reconcile overall to cost of capital and weighted average return on assets. Also, the projection period used in the financial model should reflect the estimated useful life of the subject asset. That may involve significant judgment.

With and without method (WWM)

The WWM estimates an intangible asset’s value by calculating the difference between two discounted cash-flow models: one that represents the status quo for the business enterprise with the asset in place, and another without it. The WWM is often used to value non-compete agreements.

Almost half of the global economy is already being held in intangible assets. The need to identify and value these assets grows more urgent as intellectual capital becomes more fundamental to businesses.

Don’t overlook the hidden value of intangible assets that powers your business today.

Request a meeting with VALLARIS.