Let's Talk

Request a private consultation. Discover how you can Make Your Move™.

Confused about what amount is claimable and the calculation?

The giveaway guide to understand how to qualify for damages compensation.

DownloadLegal disputes between parties commonly arise from either:

In both the above situations, the payment of money is a litigation settlement objective.

The money can relate to either the performance of a contractual obligation, or as monetary compensation for the failure to fulfil a contractual or tortious duty.

A business valuer is brought in to determine the amount of money to be paid.

Contract related valuations commonly arise because either:

Examples of contracts that include valuation include:

Shareholder/Partnership Agreements

A shareholders’ agreement is an agreement between the shareholders of a company which generally sets out the shareholders’ rights, privileges and obligations along with the foundation of how the corporation will be set up, managed and run.

Such agreements may contain a clause relating to the transfer of shares. The clause may detail a formula that dictates how the prices of shares to be bought/sold are to be measured. More commonly, the clause will ask for an independent business valuer to be appointed to determine the value of the shares. This can occur if parties disagree on the value of the shares to be transacted.

A business valuer’s obligation for such assignments follows the terms of the agreement signed by the shareholders. He may be asked to be either an expert or an arbitrator. A business valuer may arrive at a different estimate of value based on the terms of his appointment and obligations attached to his capacity.

Loan Agreements

Loan agreements are binding contracts between two or more parties to formalize a loan process. There are many types of loan agreements, ranging from simple promissory notes between friends and family members to more detailed contracts like asset financing, working capital, auto loans, credit card and invoice factoring loans.

In the case of secured loans, the collateral may include cash, unquoted shares, property, or even cryptocurrency.

In such cases, a business valuer can be called in to value:

Construction Contract Variation Orders

A variation order is a written agreement to change the work from that agreed in the contract.

Such variations may require adjustments to the contract price. One approach to price adjustment is for a quantity surveyor to value the cost of construction works.

Insurance Policies

An insurance policy helps you cover loss should something happen.

An insurance policy is a contact between a policyholder and an insurance company, i.e. provider. Under the contract, the policyholders pay regular amounts of money (as premiums) to the insurer, and the insurer pays the policyholder if the sum assured on unfortunate event arises, for example, untimely demise of the life insured, an accident, or damage to a house.

The valuation clause in insurance policies specify the amount of money the policyholder will receive from the insurance provider if a covered hazard event occurs. This clause stipulates a fixed amount to be paid in the event of a loss for an insured property.

For example, the valuation clause may require the business valuer to estimate the ‘reinstatement / replacement as new’ cost or the indemnity value.

This refers to the act of fixing a value upon the amount of money to compensate the plaintiff for his loss that resulted from the defendant’s breach of contract.

Damages in tort aim to restore the claimant to his pre-incident position.

The quantum to be paid can be assessed using different bases including:

Account of Profits

Account of profits is common in cases involving breach of duties by company directors and trustee breaches.

A remedy, fair to all parties, which aims to cut the profits made through committing an equitable wrong.

Account of profits involves calculating the profit that the defendant made in breaching their duties. This is so that profits made can be returned to the plaintiff.

Account of profits does not aim to punish the defendant, but rather serve justice by taking away the profits made by the defendant in committing a wrongful act.

The business valuer’s roles is to assess the amount of profit the defendant has made by breach of contract.

Expectation Loss

Damages awarded when a party breaches a contract that are intended to put the injured party in as good of a position as if the breaching party fully performed its contractual duties.

Reliance Loss

Damages awarded for losses suffered in reasonable reliance on a promise.

Reliance damages are calculated by asking what it would take to restore the injured party to the economic position occupied before the party acted in reasonable reliance on the promise.

Restitution

Refers both to disgorging something which has been taken, and to compensation for loss or injury done.

Disgorgement is a remedy requiring a party who profits from illegal or wrongful acts to give up any profits he or she made as a result of his or her illegal or wrongful conduct. The purpose of this remedy is to prevent unjust enrichment.

In civil cases, it is a remedy associated with unjust enrichment in which the amount of recovery is typically based on the defendant’s gain rather than the plaintiff’s loss.

A tort is a civil, as opposed to criminal, wrong that causes a claimant to suffer loss or harm, resulting in legal liability for the person who commits the tortious act.

Generally, every claim that arises in civil court, with the exception of contractual disputes, falls under tort law.

While there are many types of tort, the ones that involve a business valuer and/or forensic accountant include:

The aim of damages in tort is to put the injured party in the same position as he would have been in if the tort had not occurred. Damages in tort aim to restore the claimant to his pre-incident position.

Business valuers tasked to determine the quantum of tortious damage aim to calculate the amount to put the plaintiff in a financial position they would have been if the tort had not been committed.

A non-breaching party has the right to damages, i.e. a money award. The money award aims to make the plaintiff whole, unless the contract itself or other circumstances suspend or discharge that right.

exhibit 2: types of damages

Damages

Damages refers to money paid by one side to the other. It is a legal remedy. There are five different types of damages: compensatory, statutory, nominal, punitive and restitutory. We highlight below where economic loss and damage sits within this framework:

Economic damages

Economic damages refers to compensation for objectively verifiable monetary losses such as past and future medical expenses, loss of past and future earnings, loss of use of property, costs of repair or replacement, the economic value of domestic services, and loss of employment or business opportunities.

Many economic damages are easy to prove because victims will often have bills that specifically support their claims.

Non-economic damages

Non- economic damages refers to compensation for subjective, non-monetary losses such as pain, suffering, inconvenience, emotional distress, loss of society and companionship, loss of consortium, and loss of enjoyment of life.

exhibit 3: damages calculation

Personal damages arise most commonly in litigation involving wrongful death, personal injury, employee discrimination. These causes can give rise to economic loss.

Wrongful death is a legal term that refers to circumstances when a person dies due to someone else’s negligence such as mishandled medical procedure, falling of property that caused death and etc.

A personal injury is defined as the physical, mental or emotional injury that is suffered on your body by another. This could arise from a traffic accident, workplace accident, or negligence of others. Victims of personal injury are entitled to financial compensation for their past and future expenses, economic losses, or incidental costs caused by the accident.

Employee discrimination can translate into personal damages when it results in economic losses suffered by an employee who faced discrimination. For instance, an employee was dismissed for race or religious factors. Such wrongful termination caused the employee to lose a job or even affect his or her reputation from further employment search caused economic damage can be recovered.

Business losses are associated with antitrust, breach of contract, environmental concerns, intellectual property infringement, or securities fraud. Regardless of the nature of the incident, the assessment of economic damages proceeds from an understanding of the legal theory of the case and the associated remedy.

A common issue in quantifying intellectual property damages is price erosion. In some of the more complicated situations, damages analysis is requested to analyze how an entire sector and industry would be affected by the defendant’s wrongdoing. This includes false advertising causing price erosion. Damage analysis also takes into account that other firms beside the plaintiff might enjoy the benefit. Thus, a comprehensive and full economic damage analysis would give a more accurate representation for the case. Statistical science is used frequently in assessing economic damages associated with product liability, class actions, business litigation, and various other types of disputes involving alleged losses to individuals or businesses. In such projects, we work with statisticians to collect and analyse sample data to make defensible extrapolations to larger populations of interest, or we may evaluate the validity of extrapolations performed by others.

When estimating business loss, lawyers often mention either expectation or reliance damage.

Expectation damages are frequently awarded when a party breaches a contract. Expectation damages are meant to put the other party in the position they would have been in had the contract been fulfilled.

Reliance damages apply to torts, and sometimes to a breach of contract. Reliance damages are intended to put the injured party in the position they would have been in had the contract never been made in the first place. Reliance damages may also be appropriate in situations where it is difficult to estimate expectation damages.

In a business context, there are good reasons why we typically award expectation damages for breach of contract. Unless there is an opportunity for an efficient breach, we want to encourage people to stick to their deals. Business runs on deals, and rules that encourage people to break deals would increase uncertainty. Uncertainty is bad for business, so we favor rules that increase stability and predictability.

Business interruption refers to the disruption of operations as a result of a definable event that is beyond the entity’s control. In legal contract terms, business interruption means the financial impact of such a disruption over a period of time.

Business interruption insurance claims

Business interruption insurance policies provide a business with insurance coverage for an unexpected interruption of its earnings stream as a result of a covered peril. Such an interruption can result from natural or man-made disasters. The underlying basis for recovery, however, is damage to income-producing property. A business interruption policy is often an endorsement to a property coverage form or sold as part of a property insurance program.

Most litigated insurance disputes arise from disagreements over policy coverage issues and include the following:

Understanding business interruption claims

exhibit 4: business interruption claim formula

In contrast to tort and most other contractual claims for consequential damages for lost profits, experts look to the methods specified in the applicable insurance policy when calculating business interruption insurance claims. Disputes arise over how to interpret the contract language about quantifying business interruption damages, but the formula for quantifying the recoverable damages is generally an overt term of the contract and will ultimately establish the bounds of recovery.

We describe a generalized approach to quantify economic damages below. In reality, economic damages are harder to quantify than expected as we need various factors such as missed opportunities cost as a result of entering into a contract under impressions.

Focus only on the effect of the harmful act

The first step is to analyse the economic impact of the event in the plaintiff suffered monetary losses. An analysis is to be done to find out the difference between the plaintiff’s economic position if the harmful event had not occurred and the plaintiff’s actual economic position.

Economic damage is the difference between that forecasted vs actual value that the plaintiff achieved because of the harmful event. For most cases, it starts with the hypothesis that the wrongful party (defendant) has committed the harmful act and that the act was unlawful while the victim (plaintiff) is entitled to compensation for losses sustained from a harmful act of the defendant. The characterization of the harmful event begins with a clear statement of what occurred and a description of the defendant’s unlawful actions and the economic situation absent the wrongdoing. The “but for” scenario will create the settling defendant’s proper actions replacing the unlawful ones which damages is then being a measure to calculate the plaintiff’s hypothetical value.

Agree on heads of damage

Decide on the heads of damages. These are the elements in a compensation claim that the Court awards a monetary amount towards. These elements make up your total ‘damages’ or the amount of compensation awarded.

When VALLARIS works with your lawyer to investigate economic loss, our role is to describe, assess and quantify either pure or consequential economic loss. This can be either personal or business in nature, or relate to a business interruption insurance claim.

Estimate economic damages

The actual calculation of economic damages can be rather complex. It may even be uncertain which economic or valuation expert is needed. To illustrate with an extreme example, hedonic damages are a subjective court award to compensate the plaintiff for experiencing a loss of enjoyment of life that due to pain and suffering caused by a damaging event. Accounting valuation typically does not measure these forms of damages as its highly subjective nature leads to unreasonable certainty and difficulty in quantifying.

Such economic loss estimates often requires access to specialized technical or financial skill sets, as well a seamless collaboration with the rest of your advisory team.

Are you are a business owner that has suffered economic loss?

Economic loss may arise from a breach of confidence, unlawful conspiracy, infringement of intellectual property or confidential information. If you or your business has suffered a legitimate economic loss, know that you can legally be compensated for your damages.

Laws change on a regular basis, so if you have a question as to whether the economic loss rule may apply to you, then you should contact a lawyer who can advise you appropriately. In some cases, while injuries may be limited under one theory by the economic loss doctrine, another theory may allow it. So, be sure to seek advice of counsel if you are in doubt or you may end up short-changing yourself.

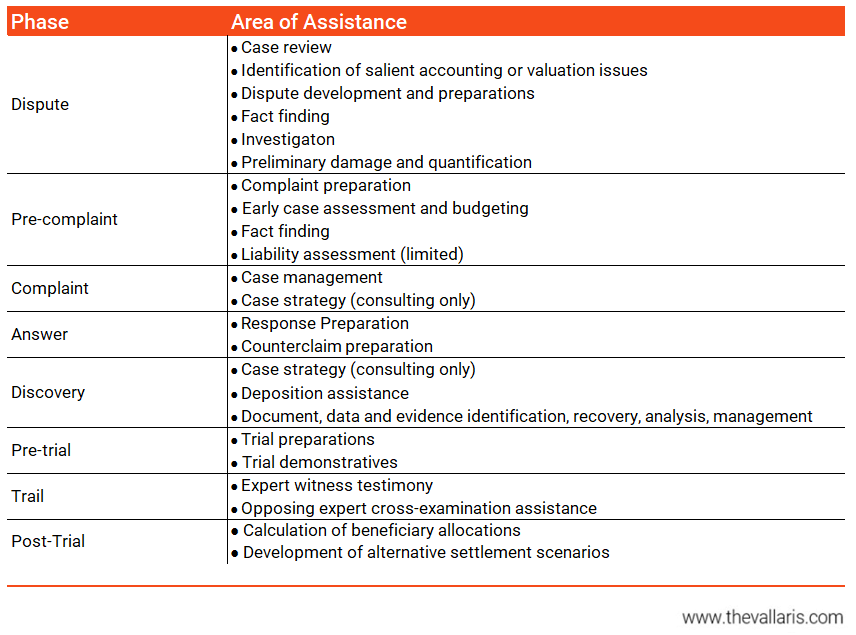

exhibit 5: dispute advisory specialist areas of assistance

If you are a lawyer working on an economic damages claims suit, we’ll be happy to share how VALLARIS has advised in similar engagements.

Request a meeting with VALLARIS.