Let's Talk

Request a private consultation. Discover how you can Make Your Move™.

Regulators and investors are demanding transparency for private equity funds. The shift in global trends in fair value accounting and the increasing importance placed on fair value by international accounting bodies, as well as European regulators, necessitates traditional valuation approaches in private equity be revisited.

The giveaway guide to navigate portfolio company investment valuation reporting confidently.

DownloadPrivate investment entities often own a portfolio of securities, businesses, and other property. These include both public and privately held assets. Establishing a market value of publicly held assets is simple. However, the financial performance of privately held assets tend to be opaque. Evaluation of these entities’ investment holdings by an independent third party provides more transparency into the value of the assets they hold.

Periodic portfolio valuation is done to determine and report illiquid investment performance, which is often required for financial reporting and tax compliance, and also affects the investment manager’s compensation. Venture capital, private equity and fund managers are increasingly seeking independent portfolio valuation services from professionals with expertise in valuing illiquid assets like businesses and securities.

Portfolio investments can be made of all types of debt, equity hybrid securities as portfolio composition is typically dictated by a fund’s investment policy. These portfolios have grown complex over time as investors pile into businesses related to the rise of the intangible economy.

Pension funds typically prioritise yield so that they can meet monthly cash payment obligations.

exhibit 1: portfolio investment building blocks

On the other hand, venture capital and private equity funds prioritise growth so that they can sell for capital gain when the fund reaches maturity.

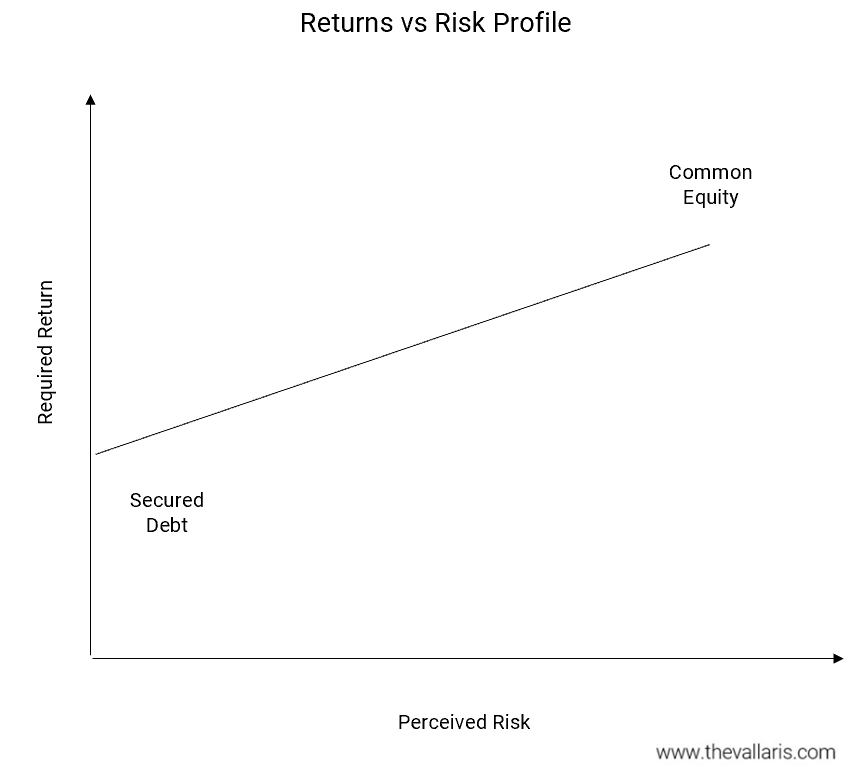

exhibit 2: returns vs risk

Funds aim to maximise returns per unit risk, but their investment criteria comprise more than just yield and capital gain. Additional investment criteria often include security of capital, a right to partake in interest, dividend and/or capital growth, board representation or liquidation preference. The features important to the investor all contribute to the final instrument type, with its bundle of rights and obligation, that is agreed between the investor and portfolio company.

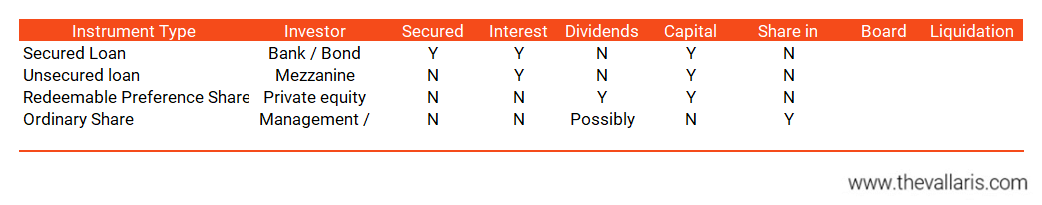

exhibit 3: designing financial instruments

Notwithstanding the above, all portfolio company investments must be reported in an acquirer company’s financial statements. The main challenge with portfolio company investments is that these financial instruments each come with a different bundle of rights and obligations, all of which impact the portfolio instrument’s value.

The financial reporting standards require that all these financial instruments be measured at fair value. How should we measure its fair value since the price paid represents the value of a financial instrument’s bundle of rights and obligations rather than the value of the underlying business’ common equity?

Auditors and business valuers in Singapore had until recently referenced Singapore Financial Reporting Standards (“FRS”) 109: Financial Instruments to value portfolio company investments. While FRS109 provides guidance on the classification, measurement, impairment and hedge accounting of financial instruments, it is silent on how changing business value affects the value of the financial instruments issued by a business as part of a complex capital structure. Another way to put it is that FRS109 prescribes guidance on how to value a financial instrument on a standalone basis.

The main challenge with portfolio company investments is that a portfolio company investment’s value is not only dependent on the financial instrument’s features, e.g. terms and conditions. Value also dependent on how these rights and obligations interact with those of the other classes of financial instruments issued by the business. The fair values of individual portfolio company investments changes as the underlying business value changes. In addition, how business value is allocated to each portfolio company investment changes over times as well.

Asset managers sometimes ask why the historical price paid for a financial instrument, e.g. Series A convertible debt, may not represent its current value on the balance sheet as at financial year-end, and the auditors request that they re-measure investments at fair value.

Another common question asked is if the price paid for the latest investment round, e.g Series B preference shares, can be used as a proxy for the current value of an earlier investment round, i.e. the aforementioned Series A convertible debt since that represents the price investors are willing to pay today.

The answer to both the above questions is, no.

A portfolio company is typically a fast-growing start-up whose value changes quickly and significantly. What was paid for a share in a portfolio company just months ago may no longer represent the current value of the company. Also. The reason why different funding rounds are demarcated by different letters, e.g. Series A, Series B, etc, is not only because of timing differences but also because they represent different bundles of rights and obligations.

Investors in earlier rounds tend to have ideal structures that provide them greater returns should the portfolio company succeed, but also poorer protection to cover downside risk relative to investors who come in at later funding rounds and who are willing to accept lower returns in exchanges for lower risk. Given the above challenges, we’ll have to look elsewhere to establish the current values of these portfolio company investments.

Say a year ago, your venture capital firm has purchased preference shares of a tech start-up which will revolutionise current payment methods. You brought 100,000 preference shares for $1 per share in a Series A financing round. The start-up has an initial paid-up capital of 400.000 common shares at $1 per share. Fast forward to today, how much are your preference shares now worth? Following are the steps to a portfolio company investment is valued:

1. Determine enterprise value of portfolio company

The first step to the whole valuation exercise is to determine the value of the portfolio company. Only after we have established the value of the business can we allocate this value into the constituent financial instrument, e.g. the portfolio company investments.

2. Determine capital structure of the portfolio company

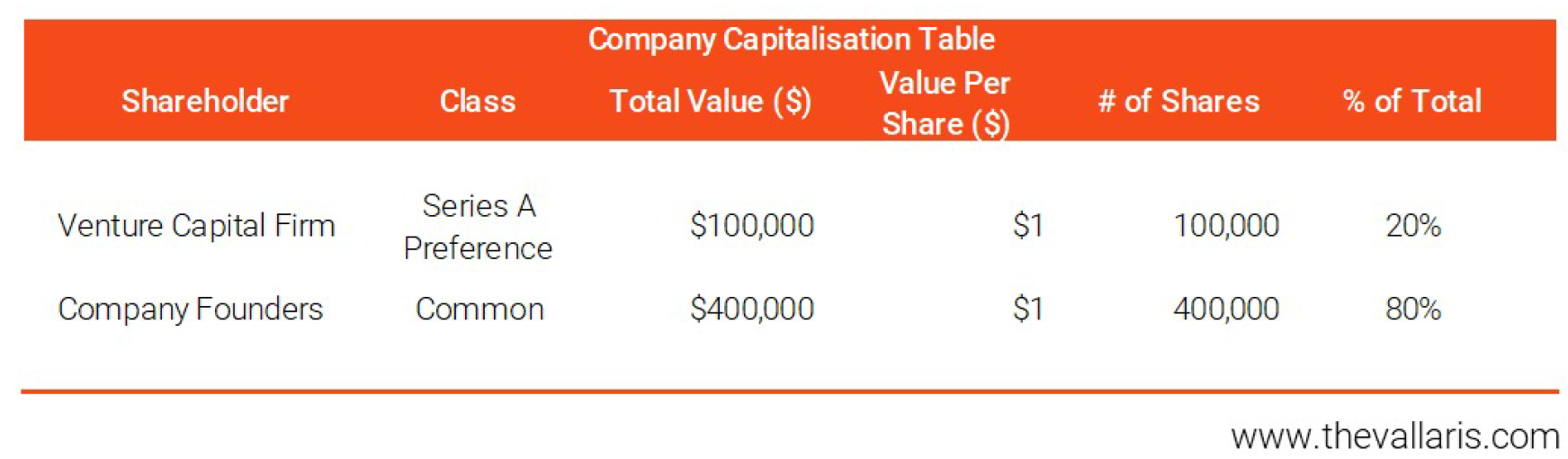

Once we have estimated the value of the portfolio company’s business, we next analyse the company’s capitalisation table, cap table in short A cap table is a spreadsheet or table that shows the capital structure for a company. It is most commonly utilised by start-up or early-stage business although it can be employed by all types of companies. This is an example of how a cap table looks.

exhibit 4: capitalisation table

A cap table lists all securities issued by a company, who owns them, and what prices were paid for the securities. These may include common or preferred equity, and/or redeemable debt, warrants etc. Overall, a cap table shows the total value of funds raised by a company and its components.

Every company should maintain a cap table to keep track of who owns how much of the portfolio company. The information is also used to decide how much of business value each capital provider can recover in the event of liquidation, and how much existing shareholders may be diluted when managing future funding rounds.

Therefore, cap table management is key to negotiating with investors and maintaining meaningful stake for founders, employees, and existing investors.

3. Allocate enterprise value to investments

After we have established the business value and the bundle of rights and obligations attributable to each financial instrument, we then allocate business value to the different financial instruments in the capital structure.

This can be illustrated in 3 scenarios:

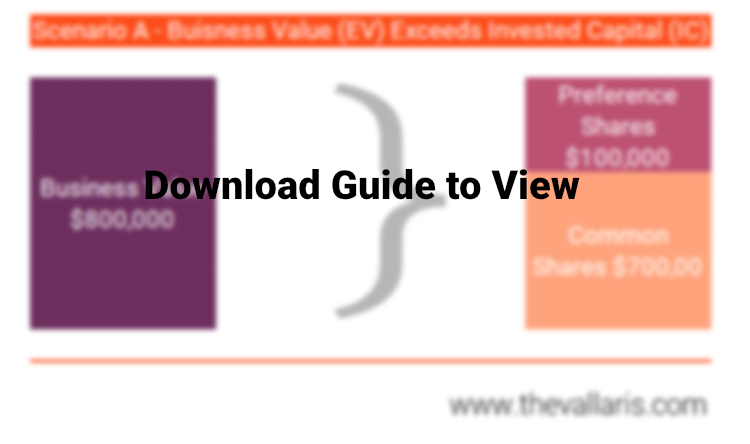

exhibit 5: business value exceeds invested capital

Where the EV exceeds the IC, the preference shares will be capped at their IC of $100,000. The residual value in the company flows to the common shareholders.

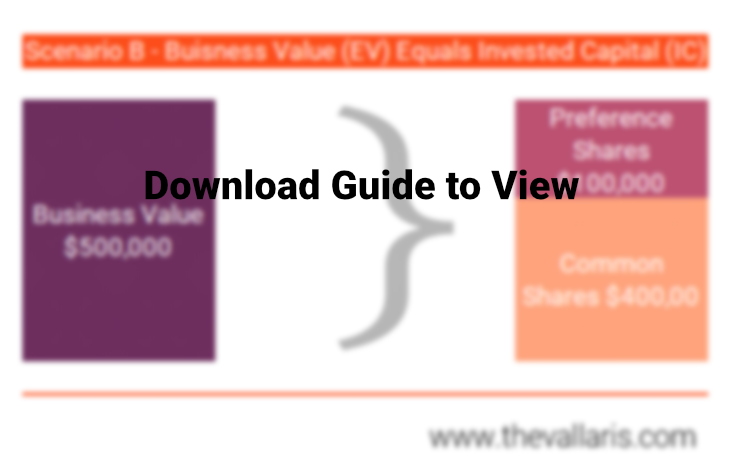

exhibit 6: business value equals invested capital

Where the EV equals the IC, the value of the business is fully allocated to both preference and common shares according to their paid-up value.

exhibit 6: business value equals invested capital

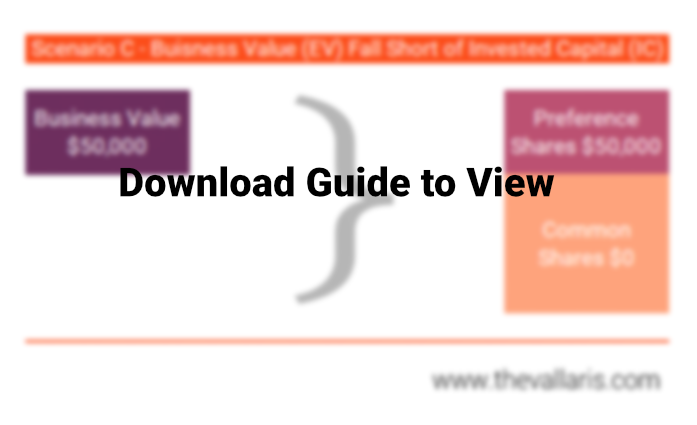

When the EV falls short of IC, preference shareholders will have priority claims over the company before the common shareholders, up to the value of their invested capital. The common shareholders will only have claims to residual value.

In the event where the EV is lower than the IC of the preference shares, it then follows that not only would preference shareholders not be able to fully recover the IC, the value of common shares will also have zero value.

A fund may invest in multiple funding rounds in a portfolio company. Each round’s funding terms may vary risks, rights and obligations via different instruments (debt & equity). The above steps allocate the value to each individual financial instrument simplified for the sake of illustration.

In the real world, investors are unlikely to invest using straight equity. They often demand both downside protection of their invested capital, e.g. via a liquidation preference legal clause, as well as upside participation in shareholder returns. A common mechanism to enable upside participation is to include a legal clause to convert their invested capital to common shares, i.e. conversion option.

With a conversion option in place, a rational shareholder will choose to convert if the conversion value exceeds the straight value, i.e. the invested capital. Conversion value refers to the financial worth of the securities obtained by exchanging a convertible security for its underlying assets, e.g. common shares.

When investors introduce legal clauses to drive specific investment objectives, the resulting capital structure becomes more complex. Different investors may also choose to convert at different times depending on how their financial instruments’ deal structure interacts with the value of the underlying business. Investors now have a choice between conversion value vs straight value should they wish to sell their investment. It is not a stretch of the imagination to say that all these moving parts dramatically increases the complexity of portfolio company investment valuations.

While the above example considers only a non-convertible preference share with one round of financing, the private equity market typically has more rounds of financing with much more complex capital and debt structures.

The good news is that VALLARIS’ valuation specialists have delivered a wide range of company portfolio investment valuation engagements with complex capital structures. We have extensive portfolio experience across a myriad of financial instruments, deal structures and industries. We have also access to proprietary databases across various portfolio investment assets classes to help with your valuation exercise.

Maintain stakeholder trust. Get investment portfolio values right.

Request a meeting with VALLARIS.