Let's Talk

Request a private consultation. Discover how you can Make Your Move™.

Complex valuation decisions frequently confront advisors planning both pre-deal allocations and well as the post-closing financial reporting.

The giveaway guide that decodes why the price paid of a business may not be not equal to the value received.

DownloadSuppose you paid $10 million for a business that had just $3 million of net assets. How would you allocate the additional $7 million purchase price? The answer used to be very simple and comprise one word, i.e. ‘goodwill’.

Goodwill is the ‘asset’ that is associated with the purchase of one company by another. Specifically, goodwill is the portion of the purchase price that is higher than the sum of the net fair value (“FV”) of all of the assets purchased in the acquisition and the liabilities assumed in the process.

Goodwill includes items including proprietary or intellectual property and brand recognition, which are not easily quantifiable. Taking the difference between what was paid, i.e. purchase consideration, vs what was received, i.e. net assets received, is known as the purchase method in accounting parlance.

However, with the release of Financial Reporting Standards 103: Business Combination (“FRS103”) in 2004, purchasers can no longer adopt the purchase method. Acquisition accounting was introduced in FRS103 to replace the purchase method. Acquisition accounting is preferred because it strengthens the concept of FV. It focuses on prevailing market values in a transaction and includes contingencies and non-controlling interests, which were not accounted for under the purchase method.

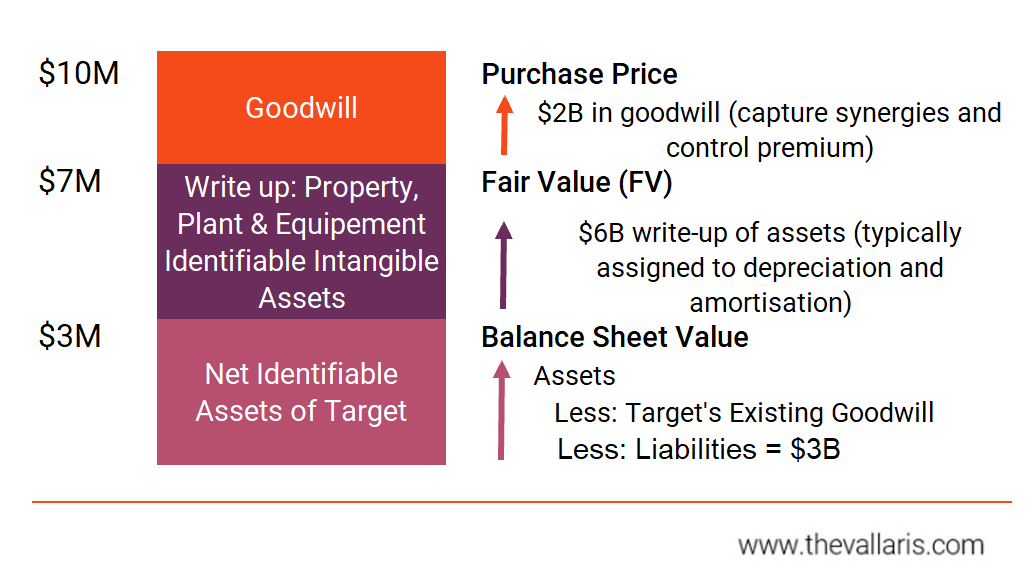

exhibit 1: purchase allocation example

FRS103 requires an acquirer to allocate the purchase consideration, i.e. the $10 million price paid, to the acquired assets and liabilities, with the residual value then attributable to goodwill. So instead of automatically taking the purchase consideration – net assets received = $3 million, a PPA exercise must first be performed to FV the balance sheet. What’s special about this accounting exercise is that the valuer must identify and intangible assets that were previously not recorded on the books of the target due to accounting rules.

Collectively, the process of conducting the appraisal, reporting the FV of the assets and liabilities, the allocation of the net identifiable assets from the old balance sheet price to the FV, and the determination of the goodwill in the transaction, is referred to as the PPA process.

A PPA exercise is typically conducted for financial reporting purposes after the deal is closed. There are some purchasers who request a pre-deal PPA to study the financial accounting effects of the deal ahead of time.

A pre-deal PPA exercise provides a basis for purchase consideration for the business to be acquired. This is done by identifying and measuring the fair values of all material assets and liabilities on a balance sheet from the buyer’s point of view. A business valuer can help identify and value previously unrecorded intangible assets, e.g. brands, patents, customer contracts, right of use agreements, etc, so that management can explain the basis for arriving at the purchase consideration.

Why request a pre-deal PPA? If management pays a high price they cannot explain, as evidenced by a goodwill amount that is a higher than 20% – 30% of purchase consideration, this may indicate that they have overpaid for the target. This may lead to awkward questions from investors at the next Annual General Meeting.

Regardless of when a PPA exercise is commissioned, the exercise answers three very important questions that most buyers would like to know, which are:

Closing the deal for purchase or spin off a business unit usually seems like the last step in a mergers & acquisitions (“M&A”) cycle. When the M&A advisor and lawyer completes their engagements, integration of newly acquired business begins. The purchaser’s financial statements need to properly record the transaction that has just taken place. The financial reporting process is known as acquisition accounting.

Acquisition accounting is a set of formal guidelines describing how assets, liabilities, non-controlling interest (“NCI”) and goodwill of a purchased company must be reported by the buyer on its consolidated statement of financial position. Acquisition accounting is also referred to as business combination accounting.

The FV of the acquired company is allocated between the net tangible and intangible assets portion of the balance sheet of the buyer. Any resulting difference is regarded as goodwill. All business combinations must be treated as acquisitions for accounting purposes.

Complexities of integrating financial statements

Acquisition accounting improved the transparency of mergers and acquisitions (M&A) but did not make the process of combining financial records easier. Each component of assets and liabilities of the acquired entity has to be adjusted for fair value. These include assets and liabilities ranging from property, inventory, hedging contracts, contractual and contingent labilities to name just a few.

The amount of work needed to adjust and integrate the books of the two companies is one main reason for the long period between agreement on a deal by the respective boards of directors and the actual deal closing.

Alignment of accounting principles

It may be that the acquired company adopts accounting principles that are different from the purchaser. Therefore, as a first step, the financial statements of the target is to be aligned with the accounting principles of the purchaser. In case the target is to switch from Chinese Accounting Standards (“CAS”) to International Financial Reporting Standards (“IFRS”), this could be quite a significant exercise with, for instance, requirements of IFRS 15 (revenue recognition) or IFRS 16 (lease accounting).

Challenges with allocating purchase consideration

If the purchase price was paid exclusively in cash, but also partly in equity, or in deferred or conditional payments like earn-outs, it means that the cash equivalent value of the purchase price is not entirely clear at the moment the PPA is performed.

Challenges to tax optimization

Tax authorities may compare accounting vs tax positions in respect of asset allocations to ensure that buyers are not evading tax. In asset deals, buyers often wish to allocate value to assets that don’t attract tax e.g. goodwill, and avoid assets that do attract tax e.g. inventory. There are also assets that don’t attract upfront tax during the transaction and a buyer may be able to recapture capital writing down allowances e.g. intellectual property and fixed assets. Please feel free to reach out to VALLARIS if you wish to leverage tax due diligence or tax structuring services to optimize your M&A tax strategy.

Fair value adjustments

The purpose of the PPA is to evaluate if the fair value of all assets and liabilities on the opening balance sheet is different from the stated book value. If there are material differences between fair value and book value, the asset or liability is revalued in the balance sheet to its fair value, with the goodwill amount as balancing item. The usual suspects for revaluation include real estate, machines and equipment, inventory, investments in associates, but possibly also long-term loans. The most tricky bit of a PPA is the FRS103 requirement to identify and value intangible assets internally generated by the target.

Identification, recognition and valuation of new assets and liabilities

In addition to potential fair value adjustments for existing items on the opening balance sheet, the acquired entity may also have assets and liabilities that did not meet the criteria for recognition before. For example, if a company has an internally developed patent, this valuable patent would not show on the balance sheet. When this company is acquired, the purchaser will certainly have considered the patent in the purchase price he was willing to pay and will in turn have paid ‘goodwill’ for it. In that case, the reporting standards require the valuation and recognition of the brand name in the books. Other examples of such identifiable items include trade names, trademarks, customer contracts, customer relationships, databases, trade secrets, favourable or unfavourable contracts and contingent liabilities.

Before we dive into the how, let us look at the what first. Purchase consideration comprises four components, namely:

Intangible assets in most cases are valued using discounted cash flow(“DCF”) analysis and used an internal rate of return (“IRR”) for analysis. The IRR analysis is based on the purchase price paid for acquired firms and a forecast of financial representing the income accountable to the acquired business. Income identified is allocated to intangible assets such as trade name, network with customers and suppliers etc on the basis of the amount of total acquired business in relation to the estimated remaining economic useful life.

exhibit 2: five steps to purchase price allocation

1. Determine the fair value of the purchase consideration

The first step to the whole purchase price allocation exercise is in determining what is the value of purchase consideration. While a purchase consideration typically involves cash on closing, there are times where there are more terms and conditions attached to it. The fair value of a full cash payment is easy to determine, which is its face value. However, things start to get complicated when, for example, a deferred payment is part of the deal structure. A deferred payment may include payments that are made only after certain performance milestones related to the acquired business are met post-acquisition. This type of deferred payment that is made only after precedent conditions are met, i.¢. contingent consideration is called an earn-out.

Determining the fair value of purchase consideration with complex deal structures, for example (1) a mixture of payment modes, e.g. cash and non-cash, (2) at different timings, e.g. on closing or on the third anniversary of the acquisition of the business, (3) and/or requires the fulfilling of precedent conditions requires a rigorous evaluation process involving high levels of professional judgement and expertise that is acceptable by auditors and incompliance with Financial Reporting Standards.

2. Identify and fair value and previously unrecorded intangible assets

exhibit 3: sample intangible assets

This is the most interesting and subjective part of the PPA. Any identifiable intangible assets that arise due to the acquisition, such as brands, patents, customer contracts, right of use agreements, etc, must be recorded separately from goodwill. Due to the subjective nature of intangible asset identification and measurement, an experienced business valuer will engage your auditors early for their buy-in so as to minimize the chances of disagreement after the draft PPA report is issued.

3. Identify and revalue all identifiable assets and liabilities assumed

In this third step, all existing assets and liabilities assumed will have to be assessed and recorded at fair value. Typically, fixed assets on the books such as the property, plant and equipment and financial assets will be reevaluated to fair value as of acquisition date.

4. Estimate deferred taxes arising due to fair value changes

Deferred taxes often arise in a PPA exercise due to temporary differences arising from fair value changes. A temporary difference is the difference between the carrying amount of an asset or liability in the balance sheet and its tax base. A temporary difference can be either of the following:

5. Record the difference as goodwill or gain from bargain purchase

The final step would be to record the difference between the purchase consideration and identifiable net assets (identifiable assets less liabilities) as the final balancing figure.

In the case where the purchase consideration exceeds the net identifiable assets, a goodwill is recorded in the books. Occasionally, where the net identifiable assets exceed the purchase consideration, a gain from bargain purchase Is recorded.

The overall reasonableness of the goodwill allocated must be assessed to ensure that the goodwill is not overstated or understated.

VALLARIS has guided global clients through the commercial realities underlying both the deal and the subsequent financial reporting obligations in the form of a PPA exercise.

It is important to acknowledge that an M&A deal is a cycle, where each step impacts the next. In an ideal M&A cycle, a pre-PPA analysis, focusing on the early identification of acquired assets and synergies, and on what the (consolidated) post-deal financial statements would look like, is performed before closing the deal. Also, the financial controllers delegated to perform the purchase price allocation require accurate documentation and proper support to swiftly prepare the work and obtain approval from the external auditor. This makes sure the company can focus on what actually adds value: delivering the promised returns after the transaction.

Leverage PPA to communicate that you are a savvy deal maker.

Request a meeting with VALLARIS.