Let's Talk

Request a private consultation. Discover how you can Make Your Move™.

Businesses have two choices. You choose either to change yourself, or not. If you lead change, it is called innovation. If change leads you, it is called disruption.

The giveaway guide that explains how a business can remain competitive for the next five years.

Download

We stand on the brink of a technological revolution that will fundamentally alter the way we live, work, and relate to one another.

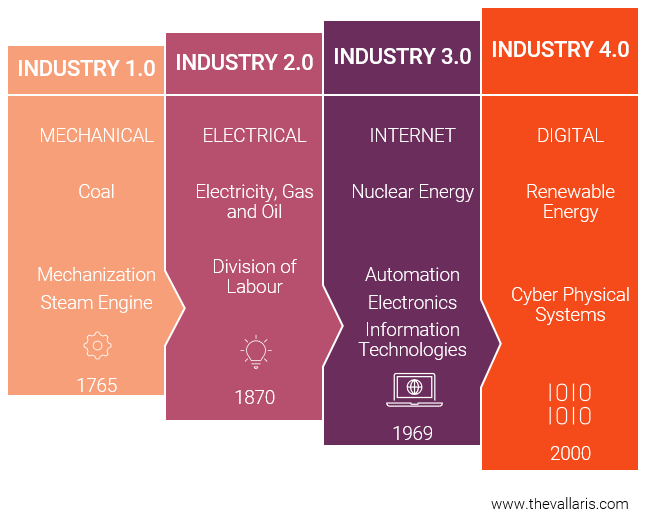

exhibit 1: welcome to the fourth industrial revolution

The Fourth Industrial Revolution will disrupt every industry in every country. It is characterized by a fusion of technologies that is blurring the lines between the physical, digital, and biological spheres. The speed of change will be exponential, not linear. The breadth and depth of these changes will transform entire systems of demand generation, value delivery, operations and governance.

We can feel change happening around us. Many business leaders say that the acceleration of innovation and disruption is hard to understand and respond to. Unlike the first three revolutions that precede the Fourth Industrial Revolution, change now crashes from multiple angles, hits harder and faster. Its effects are cumulative, each wave stacking on top of the other. The list of companies modelling the disruptive sharing economy and crowdsourcing is well known Uber, Airbnb, Etsy, etc. These companies have no inventory and no products, and yet they are worth billions.

Uber’s founder Travis Kalanick either developed or orchestrated multiple waves of innovation to make ride hailing happen. Here are some of them:

In spite of the bewildering array of innovation at play, the development guiding principle for Uber’s business to work is simple. Uber cannot afford a system failure. If an Uber customer cannot get a car, they switch to another app. There is no brand loyalty.

The above technologies were all invented during our lifetime. The problems Uber faces – and the tools it uses to solve them – are common to enterprises around the world. The dream of many CEOs is to be the next Uber. Take a look at your business. Can you split your business into supply and demand? There is a good chance you can. The next step: Is there a way to crowdsource who sells and who buys your product?

A key trend is the development of technology-enabled platforms that combine both demand and supply to disrupt existing industry structures, such as those we see within the ‘sharing’ or ‘on demand’ economy. These technology platforms, rendered easy to use by the smartphone, convene people, assets, and data, create entirely new ways of consuming goods and services in the process. In addition, they lower the barriers for businesses and individuals to create wealth, altering the personal and professional environments of workers. These new platform businesses are rapidly multiplying into many new services, ranging from transportation to shopping, from chores to parking, from appointments to travel.

Growth strategy cases typically begin with open-ended questions. “We face intense competition. How can we increase revenue?”

Growth strategy advisors will be able to answer these questions (and more):

exhibit 2: 5c analysis

One way to think about change is to start with the 5Cs analysis framework. The 5Cs involved are:

Customer analysis

Customer analysis allows a company to understand how customers discover a business’ products as well as how a business meets its customers’ needs. The purpose is to increase customer retention and lifetime value. You can read more about customers and competitor analysis under VALLARIS’ Market Intelligence service line.

Competitive analysis

The purpose of competitive analysis is to benchmark a business’ market value proposition against the competition. The aim is to find out which pain points and market segments are underserved. These can then be translated into a differentiated value proposition and a brand stand.

Collaborators

Collaborators are partners that enhance a company’s capability to serve its customers. A business maps out its value chain, then decides which capabilities it wishes to in-house vs outsource. The profitability of a business can oftentimes come down to how profit along the value chain is distributed.

Company analysis

It is to identify internal drivers of sustainable competitive advantage. Brand equity or economies of scale are often cited examples. Core competences may offer a competitive advantage today but remember this:

Some core competences offer a temporary sustainable advantage before a market trend changes the situation or competition appears. Markets are dynamic. When Steve Jobs cited ‘Stay Hungry, Stay Foolish’, he meant that that only the paranoid survive, and that you have to be open to innovation and making mistakes to chart a path forward. It’s not called innovation if the path forward is obvious.

One way to chart a path is to use the VRIO framework. VRIO stands for Variable, Rare, Imitable, and Organized. Further elaboration can be found in next section on ‘Analysis Models’.

Context analysis

It is especially important if a company is looking to venture into a new country or market. When a company expands regionally for the first time, they enter unchartered territory. The new operating environment different from the one they currently operate in and there is a lot of uncertainty. Many analysts use the PESTLE framework to scan their operating environment. PESTLE analyses factors beyond the control of a business yet may significantly affect its fortunes.

Strategic analysis is the process of transforming market and organizational intelligence into a business strategy. The process involves the following common steps:

exhibit 3: five step strategic analysis process

We’ll explain VIRO, VCA, PESTLE and SWOT, four common strategic analysis tools and how they can help your business.

VRIO Model

exhibit 4: viro model

VRIO is an acronym for a four-question framework of value, rarity, imitability, and organization. It is used to uncover ‘sustained competitive advantage.’ The four components of VRIO analysis are approached as a decision tree.

exhibit 5: viro framework

a) Value

Value can be seen in two ways. External value to customers or internal value to the business. An inability to uncover value in this first step means your business suffers a competitive disadvantage. If value is identified, we then assess its rarity.

b) Rarity

A rare resource translates into pricing power. If demand exists, but the customer is unable to find substitute supply, the supplier is now able to dictate terms in a transaction.

c) Imitability

Competitors take notice when your business gains win customers. The business will attract imitators. How easy is it for the competition to reverse engineers what you are doing and take business away from you? The harder it is to reverse engineer what you offer, the more enduring your competitive advantage.

d) Organisation

Does your organisation have the culture and resources to capture/sustain your competitive advantage?

Value Chain Model

Michael Porter’s value chain analysis (VCA) answers the question “How is value created within an organization?”.

exhibit 6: value chain analysis

A value chain is a set of activities an organization carries out to create value for its customers. Organizations use VCA to map out their key activities and see how they are connected. The way in which value chain activities are performed determines costs and affects profits, so this tool can help you understand the sources of value for your organization.

Understanding how your business creates value, and looking for ways to add more value, are critical elements in developing a competitive strategy. The more value an organization creates, the more profitable it is likely to be. And when you provide more value to your customers, you build competitive advantage.

PESTLE Model

A PESTLE analysis is an acronym for a tool used to identify the macro (external) forces facing an organisation. The letters stand for Political, Economic, Social, Technological, Legal and Environmental.

exhibit 7: pestle model

Before implementing a growth strategy or tactical plan as part of business development, it is fundamental to conduct a situational analysis. And the PESTLE forms part of that and should be repeated at regular stages (six monthly intervals at a minimum) to identify changes in the macro-environment. Organisations that successfully monitor and respond to changes in the macro-environment are able to differentiate from the competition and create a competitive advantage.

exhibit 8: pestle considerations (political & economic)

a) Political

These factors include how anything related to government may impact your industry and business. This includes political policy and stability as well as trade, fiscal and taxation policies.

b) Economic

These factors affect the economy and its performance, which in turn impact industry and business. Factors include demand vs supply, inflation rate, interest rate, employment level, gross domestic product growth rates, foreign exchange rates.

exhibit 9: pestle considerations (social & technological)

c) Social

These factors affect the social environment and emerging trends. This includes factors related to people, e.g. demographics – population growth rate, and ‘softer’ issues such as attitudes towards health and safety, or seasonal buying trends.

d) Technological

These factors study how technological innovation impacts an industry or business. Examples abound, including the aforementioned blurring of lines between the physical, digital, and biological spheres.

exhibit 10: pestle considerations (legal & environmental)

e) Legal

A business must understand the legal/regulatory framework it is permitted to operate within. These factors cover all legal aspects of operation, including labour and employment law, contract law, health and safety law, and elements like money-laundering laws.

f) Environmental

These factors consider the effect of the external environment on operations. This are is increasing in importance with the rise of environmental, social, and governance (“ESG”) reporting. Factors include sustainability, climate change, carbon footprint, recycling and waste disposal.

The outcomes from a PESTLE analysis can be used to populate the opportunities and threats sections of a SWOT analysis.

SWOT Model

The SWOT model organizes company’s top strengths, weakness, opportunities. It assesses an organisation’s position both internally and externally. Opportunities and threats are external factors. You can take advantage of opportunities and protect against threats, but you can’t change them. Examples include technological disruption, change in consumer trends and government regulation .

exhibit 11: swot model

When you take the time to do a SWOT analysis, you’ll be armed with a solid snapshot to prioritize the work needed to grow your business.

Competitive advantage is what drives your business growth. We have just shared some established strategic analysis tools you can use to kickstart your business transformation journey.

However, VALLARIS’ proprietary strategic analysis also covers more demanding Fourth Industrial Revolution questions:

Business is a daily exercise in attrition. Choose to thrive. Contact VALLARIS to start a conversation.

[1] http://highscalability.com/blog/2015/9/14/how-uber-scales-their-real-time-market-platform.html

[2] https://www.infoq.com/news/2015/03/uber-realtime-market-platform/

[3] https://www.cnbc.com/2019/04/11/uber-paid-google-58-million-over-three-years-for-map-services.html

[4] https://s2geometry.io/

[5] https://underhood.blog/uber-payments-platform

[6] https://www.pymnts.com/news/payments-innovation/2019/uber-money-wants-to-be-the-bank-account-for-uber-drivers/

[7] https://www.scmp.com/week-asia/business/article/2154770/who-pays-when-indonesian-ride-sharing-fraud-goes-full-throttle

[8] https://www.pbs.org/newshour/economy/uber-drivers-game-app-force-surge-pricing