Let's Talk

Request a private consultation. Discover how you can Make Your Move™.

A business that applies wholesale what works offline to online, or what works in developed markets to emerging markets is guaranteed to lose money.

exhibit 1: top 20 reasons why startups fail

Of the top 20 reasons why startups fail, it turns out that market misunderstanding accounts for 60% of post-mortems. Technology is never mentioned as a reason for business failure.

Why is that? Entrepreneurs are often able to test their technology to see if it works. However, that is not the same as finding product/market fit. Technocrats fail when they develop products in a vacuum. Others test market concepts using intuition, belief or gut feel. In other words, while engineers can evaluate product functionality, customer facing leaders base their business strategy on untested assumptions.

Technology produces objective True of False conclusions. A winning piece of software is either fuller featured or less buggy. It’s a true or false conclusion with no room for debate. Engineers are therefore surprised when customers choose to buy what the engineer believes is an inferior product.

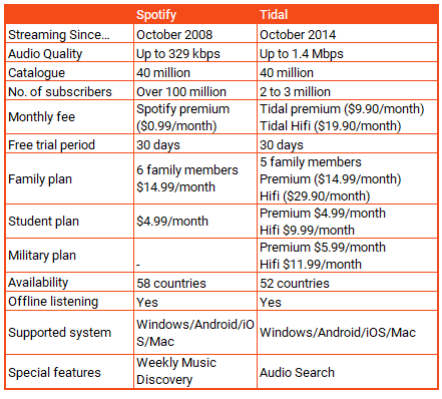

For example, in the music streaming wars, Tidal clearly has a technologically superior product. It streams music at 1.4 Mbps vs Spotify’s 320kbps.

exhibit 2: comparison between spotify and tidal

Spotify adds around 20,000 new songs every day. However, it lacks a number of exclusive songs other than Beyoncé’s album, Lemonade.

Tidal has a large library with 40 million songs. In addition, they also provide more than 175,000 music videos. More interestingly, Tidal is the first music platform known to release albums from world-renowned artists like Beyoncé, Rihanna, Drake, and Kanye West.

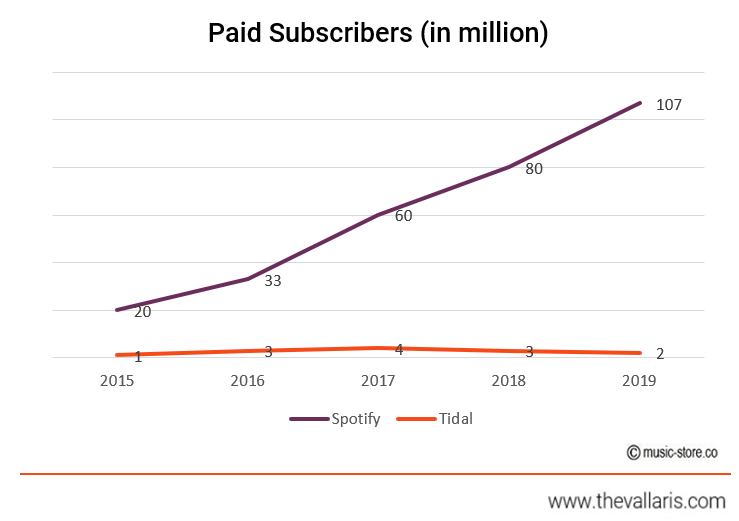

exhibit 3: number of subscribers between spotify and tidal

So it comes as a huge surprise that Tidal’s 2-3 million subscribers pale in comparison to Spotify’s over 100 million subscribers.

Tidal lost the race because it got its market facing model wrong. Turns out, the markets thinks Tidal has unremarkable selling points and image issues[1]. The problem was never a technology issue.

The purpose of market intelligence is to increase a company’s market share.

Market intelligence starts with data acquisition. Market data is transformed into market intelligence through the research, analysis and application of information. Market intelligence addresses the only two challenges a business must overcome to exist.

Successful market intelligence explains how to find and keep a customer. It covers country, industry, sector and market analysis and provides many answers such as those below, and more:

exhibit 4: market intelligence framework

Market intelligence research uses data that is both available as well as that which is no longer available, i.e. lost. Targeted data types can either be sourced externally or monitored using internal resources. For the latter, persistent monitoring is important to ensure accuracy and confidence in its application for decision making. An example of this would be to track data for market penetration and market opportunities.

The traditional understanding of market intelligence is outdated. Sales and marketing are no longer two separate functions.

Traditional customer models, e.g. demographics or intermediated marketing channels, no longer apply. It is also irrelevant to describe a marketing framework in terms of (1) physical and digital channels, (2) value and supply chains as well as (3) national boundaries vs e-commerce. All the above segmentations have been blurred by digital marketing technologies.

When VALLARIS advises on digitization, we now speak in terms of ‘demand generation’ and ‘customer success’ functions. When we advise on marketing intelligence transformation and how that impacts stakeholder value, we start with how digital technologies can help us frame the customer journey.

exhibit 5: customer journey

This article is intended to provide an overview of VALLARIS’ Market Intelligence service rather than an in-depth discussion of a very large and specialized subject matter. Please get in touch with us if you’d like to understand how your business can remain competitive in the next five years.

Market research is the act of assembling consumer behaviour data in a specific market. For instance, customers from Thailand have different needs and habits from those in Singapore. This gives rise to the need to adapt products to fit the specific markets. The research gives an understanding of the market preferences and allows the company to tailor its strategies. Usually, this research is done as the company may not have data to work on as a starting point, meaning needs primary research performed. Any company will face this situation when it moves to an unknown market segment or when it ventures to another country or region. This is why market research firms compile information that is commonly needed to sell as reports. A company may also want to combine this information with its own research, but sometimes grapple over the reliability of their own research or the correlation between the two.

Another common type of market research available is that of historical data. It may sound like a good idea at first, but it will become evident quickly that the data, like fruit, goes bad quickly. Data that ages becomes less relevant as markets innovate and get disrupted. It is risky to apply market data wholesale without understanding it in context, e.g. changes in market forces. The market research process to compile this sort of data takes substantial time and at the end of it, you get data that might not be a good representation of the company’s nor market landscapes current state.

In contrast, market intelligence uses real-time data. This is actionable data about your business and customers and for some, it may include competitor’s information as well. It helps you anticipate things ahead and ensures you keep your organisation agile with less guess work. You will always know where your organisation is and how to chart the way forward to get your organisation to an assigned goal.

While the purpose of market research is to accelerate business growth, how do we accurately translate data to intelligence to valuable insight? Data can be purchased from a marketing research firm. But each leader must ask themselves, are these firms always able to see the big picture for your specific product, market and organisation? These business insights are seldom tailored to the unique requirements of your company. As such they may not be able to translate the marketing information to actual profit and most of the time, they are not quite meant to.

Client who reach out VALLARIS want help translating data to actionable business intelligence. Leaders find it hard to hold Marketing accountable for a return on investment and want us to show them how. Finance departments are not able to interpret sales drivers and sales staff are not able to understand how sales flows down to profit. Many find that the process of describing business value to be fragmented and that the messages from various departments don’t add up to a cogent story.

Having said that, market intelligence is very closely interlinked to market research and can be described as such:

exhibit 6: market intelligence tree

Competitor intelligence

As the term suggests, it is the collection of data about your competitors. Sources include public records and government statistics, such as that from the Department of Statistics Singapore (Singstat) that provides national data. Some data has to be purchased while others are freely available. You may choose data that gives a company insight into specifically the Singapore market. For example, if a company wants to open a premium bakery in Singapore, where should it be best located? Demographics and spending data will be able to lead you to the answer. Understanding competitors also gives more accuracy to strategy. A company might be interested in setting up a central district, but without knowing the number of premium bakeries already present, the company may be subject to risks of failure through being sited in a highly competitive space. Being in an environment such as the central district which has a high concentration of premium bakeries it will give the company starting out more challenges that they are prepared to face.

Approximately 90% of Fortune 500 companies utilise some form of competitive intelligence. Advanced competitive analytics tools are equipped to handle complex data. An example of this is competitive intelligence that gives explicit directions and reduces potential waste of resources. For instance, there are markets where it is useless to attempt to overtake competitors by outspending in marketing; or markets where being the cost leader by reducing prices to attract customers work in the long term. Definitely for less price sensitive customers, it doesn’t even work at all. What is necessary is to outsmart the market and this is strengthened by the need to factor in the competitive landscape when making a decision. It is key to note not to use outdated data, and in adopting this approach, it is important to scrutinise data validity.

Product Intelligence

One key difference between competitor intelligence and product intelligence is the type of data. Product intelligence gathers information about competitors’ products or similar products that are offered in the same market. For example, electronic companies closely monitor their competitors’ product offerings. When Samsung prepares to launch new a season or product, it usually means there are promotional materials coming out soon. Assessing such information in advance could allow a competitor that can react fast to gain first mover advantage. This competitor could potentially introduce a new or differentiated product faster; or launch a promotion on existing products before Samsungs does to dilute Samsung’s potential market size of the new product. Product intelligence data enables companies to roll out launches at the right time and price.

Market insight

Market insight is knowing the market within which the company operates in. For example, the company’s market share may indicate if your organisation has done well. Observing market trends tells your company if there is a need to launch new products, and what sort of products and product differentiation are required. This can be derived also from market size information which provides details to the changing demand of your customers. The ultimate aim of any organisation is to increase their profit. Valuable market insights will enable the company to achieve this goal. For those in the telecommunications industry, if you have not understood that your customers have changed in the way they use their data and how, and your company continues to only offer the same fixed plans from 20 years ago, you will find these offerings would not only fail to retain your existing customers; needless to say, they will not attract new customers. The data consumption has drastically increased over the decade. But if you are a telecommunications company that is not providing enough data, or not providing it at a competitive price, naturally, your customers will shift to competitors who understand their needs better than you do. This is an example of how market information allows your organisation to penetrate new markets or helps your organisation to retain market share. This leads us to the next section.

Shortcut your path to profitability

Many companies lose time and run out of money because they don’t know how to develop an idea and get market traction in the shortest time possible. With the help of VALLARIS’ tried and tested market intelligence frameworks and technologies, this is no longer the case. We give CEOs a holistic dashboard the provides a bird’s eye view of how different departments and key performance indicators, including marketing, translates into stakeholder value.

Focus on agility

Organizations that are agile in nature and respond quickly to the market changes gain a competitive advantage over their competitors. In certain cases, businesses can enjoy the first mover advantage, only if they have access to accurate and reliable insights, the right data, and an effective strategy in place. We teach you what real time data sources your competition is using to leapfrog you.

Increase revenues through upselling

Businesses that offer a wide array of products or services and have a lot of customers face this problem. How do you identify which products to target for specific customer groups? This makes sales planning extremely difficult. However, data analytics driven market intelligence takes all your data feeds, and product or service information into account and subsequently offers predictive upsell and retention strategies to spur sales.

Enhance customer retention

The sales team of your company may have worked extremely hard to bring in new business from your competitors, but they are always at the risk of being under attack from your competitors. Understanding their value to you and when they are likely to leave you would be extremely useful. Market intelligence can help you analyze unstructured data and identify the crucial information to track in order to enhance customer experience and retention.

Reduce operations costs

VALLARIS dovetails market intelligence into operational efficiency by identifying process gaps, devising strategies to negate risks, and providing real-time updates. Market intelligence also drives consistency, reliability, and responsiveness across business operations.

To stay relevant in the competitive market landscape, chief marketing officers, or CMOs, need to glean more insights from customer data with the help of market intelligence. Given the competitive nature of most markets today, CMOs must peek beyond transactional data and add attitudinal data into the mix. Establishing a solid relationship with customers, interacting with them, and understanding their behavior are critical steps in gaining a 360-degree view.

There is no one-size-fits-all plan on how market intelligence should be done, nor should there be. Multi-national companies have dedicated Data Analytics departments filled with data scientists that do complex analysis on subscription software like Alteryx and Tableau. Alteryx works great for data cleaning but lacks good data visualisation capabilities. Tableau, on the other hand, is primarily a data visualization system.

Smaller businesses, on the other hand, can adopt simple and just as effective tools to gather market intelligence. The Internet is a small business’ best friend. Competitors analysis can be done easily by looking at the competitors’ websites. This type of ‘spying’ on competitors is common.

For example, many companies subscribe to competitors’ email and social media to analyse what works for them and what does not. If your customer churn rate is high, companies might want to find out where the customers are going and why. This allows the company to attract customers from the competition.

Simple market research data can be done through DIY survey tools. Businesses can use tools such as SurveyMonkey to understand the market and is particularly effective when a business has a maintained customer list or Customer Relationship Management (CRM) software. This approach can come at almost little to no cost. But companies need to have at least a basic understanding of how to conduct market research methods. Data will be inaccurate if there are no proper research controls and measurements. While there are many sources of information available online such as those from industry associations and government bodies. Unbeknownst to many, some competitors do publish their market analysis as well and the analysis reports details the markets that they are in and more. However, it is must be said that not all information online is reliable. Credibility and reliability of sources still need to be assessed before using them. It would save up some time to do your own assessment first.

The suggestions above are useful for both traditional businesses and digital businesses. On top of that, digital businesses have an additional advantage with e-commerce analytics that can be easily deployed since digital businesses have easy access to these. For instance, if your company is in the business of booking platforms, the transaction is done through an online system capturing the data. This data, such as demographics, is captured and can be easily retrieved. Every time a customer books through the system, not only is booking data captured but other forms of customer data being collected include the number of times the customer visits the system, the number of times customers visit but do not make a booking and what are they interested in. The time spent on the booking system, or even which tabs were navigated. All this data is useful to the company. One way how this data is applied now is for dynamic pricing. Companies will observe the time of day that correlates to the demand. If the system captures that there is high demand in the morning, the company may choose to raise the prices according to demand and supply. The raw data has to be analysed before coming up with the pricing strategy. This also applies to what used to be a manual process of checking in competitors. Technically, now the company can keep an eye on their competitors all the time.

exhibit 7: market intelligence analysis proces

Keeping track of all data for market intelligence can be time-consuming. Especially so if your company is small with limited resources. The solution is to digitise! Pentaho and Sisense are some of the software available in the market for business intelligence. Small businesses now have access to modern marketing intelligence tools that were previously only available to multi-national corporations. Utilising these online tools allows a company to acquire, analyse and interpret customer data in real time.

However, as the company grows and evolves, it will become increasingly challenging to keep this up. As databases get larger, more complex statistical tools will be needed to manage them. This is usually when a company employs an in-house analyst or switches to more expensive and sophisticated software. This may involve a learning steep learning curve to acquire fast-evolving expertise that requires the commitment of a full-time specialist. Hiring a third-party consultant solves this problem. An external marketing intelligence consultant provides you competitive insights and an independent perspective. Avoiding groupthink and strategic blind spots might just save you from the fate suffered by New Coke.

VALLARIS helps busineses understand jobs-to-be-done opportunities in a target market. Our research points to opportunities and threats that companies face today or in the near future. Even though market intelligence starts with raw data, its interpretation and application can vary. If available data from various departments does not tell a cogent story, stakeholders will not understand what you are selling and give you their buy-in.

In business as in life, don’t be the last to know.

Request a meeting with VALLARIS.

References

[1] https://medium.com/@alexig20/why-did-tidal-fail-d632305156c7