How Exactly Is A Startup Valued?

Every startup founder dreams of becoming the next unicorn like Sea, Grab, or Patsnap. The glamour of these billion-dollar startups motivates countless founders to chase after the ‘unicorn’ status with their own valuations.

Here are 3 of Singapore’s top unicorn companies:

Sea Limited

exhibit 1: sea founder Forrest Li

Source: sea.com

Fast Facts:

- Type: Public

- Traded as: NYSE: SE (Sea Limited)

- Valuation: USD152.34 billion (as at 17 Aug 2021)[1]

- Founded: Forrest started Garena first in 2009

- Headquarters: Singapore

- Area served: Worldwide

- Products: E-commerce, entertainment, retail

- Subsidiaries: Garena, Shopee, SeaMoney, Lion City Sailors FC

Grab

exhibit 2: Grab founders (L-R): Anthony Tan and Tan Hooi Ling

Source: grab.com

Fast Facts:

- Type: Private

- Valuation: USD40 billion[2]

- Industry : Technology, transportation, food delivery, grocery delivery, parcel delivery, e-commerce, online payment, financial services, vehicle rental, insurance, online hotel reservations

- Founded June 2012: formerly called MyTeksi in Kuala Lumpur, Malaysia

- Headquarters: Singapore

- Area served: Malaysia, Singapore, Cambodia, Indonesia, Myanmar, Philippines, Thailand, Vietnam. 8 countries, 351 cities and metropolitan areas.

- Products: Mobile app

- Services: Vehicle for hire, delivery

Patsnap

exhibit 3: Patsnap founder Jeffrey Tiong

Source: patsnap.com

Fast Facts:

- Type: Private

- Valuation: USD1 billion[3]

- Industry : All industries that require innovation intelligence

- Founded June 2007

- Headquarters: Singapore

- Area served: China, United Kingdom, United States, Singapore, Japan, Canada

- Products: Desktop app

- Services: Analytics, artificial intelligence, business intelligence

While many want to know, few can answer ‘How exactly is a startup valued?’.

Valuing a public listed company is straightforward. At its simplest, you multiply the share price by the number of shares issued by the company. The factors that drive a public listed company’s share price, i.e. its strengths, opportunities and risks. Accordingly, public company share prices are seldom off the mark.

However, the value of a startup is not easy to calculate. Startups are rarely profit-making. Some may even not be revenue-making. However, many startups have a strong founding team, intellectual capital, brand value, technology and business networks that may be very valuable.

What Is Startup Valuation?

Startup valuation is the process of estimating the value of a startup company.

A startup is a business is in first stages of operations. Just like babies, startups need money to grow, test ideas and gain expertise. A startup can be viewed as a baby first conceived as an idea, looking for capital to birth a product or service, grow and mature.

These ideas may first be bankrolled by its founders. However, many startups are capital intensive propositions that incur high development cost with little revenue to show in the beginning. That is why most startups are small scale operations that are not sustainable without additional external funding.

You’ll need money for product development, assembling a team, and other overheads that come with running a business. To raise money, a startup needs to be valued. When you pitch your idea to any investor, one the first questions asked would be “How much do you think your startup is worth?”

Understanding how startup valuation works is therefore a crucial skill for any serious entrepreneur.

How Is Startup Valuation Approached?

Startup companies often have little or no revenue.

Business owners hope for a high valuation, whereas pre-revenue investors would prefer a lower value that promises a bigger return on investment (“ROI”).

However, getting an accurate startup valuation can be tricky. Valuing a startup is an art. There can be many opinions depending on who you ask. This includes different types of investors, entrepreneurs, customers or even suppliers.

At the beginning of a startup’s journey, many things are uncertain and need to be considered. This can range from the ability and chemistry between founders, to market trends, market demand, product-market fit, and business risks.

Given the uncertainties, a pre-money valuation, i.e. the valuation of a company or asset prior to an investment or financing, is at best an estimate.

Despite the challenges, knowing how others price your business is important as it helps you structure and raise funds the right way.

Why Is Startup Valuation Important?

It gives you credibility. When investors agree to your valuation and your successful funding round gets reported in the press, you get credibility in the eyes of the public. It tells the market that others believe and are willing to back your ideas. When a sophisticated investor invests in your startup, it sends a positive signal that this is what others think you are worth as opposed to what you think you are worth.

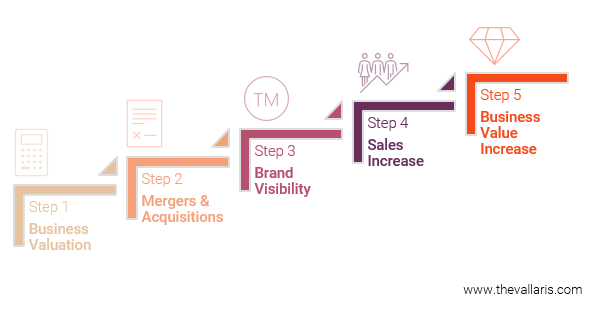

In other words, a startup valuation helps you get funded which helps you get public relations to build your brand which in turn increases your visibility and attracts more customers in the marketplace. OK, that’s a mouthful. Let me summary this powerful truth in VALLARIS’ proprietary Business Value Ascension framework below.

exhibit 4: VALLARIS Business Value Ascension framework

Source: VALLARIS

There is no universally accepted formula to value a startup. However, there are some common rules.

Venture capitalist often start with:

- the amount of money they want to exit with;

- their target ROI;

- the amount they are looking to invest;

- what percentage of the startup’s equity they aim to own; and finally

- negotiate with founders to arrive at a startup’s pre-money valuation.

So what’s pre-money valuation and why should you care? Pre-money valuation is how you value your business.

The higher and more accurate your valuation, the higher of chances to attract funding.

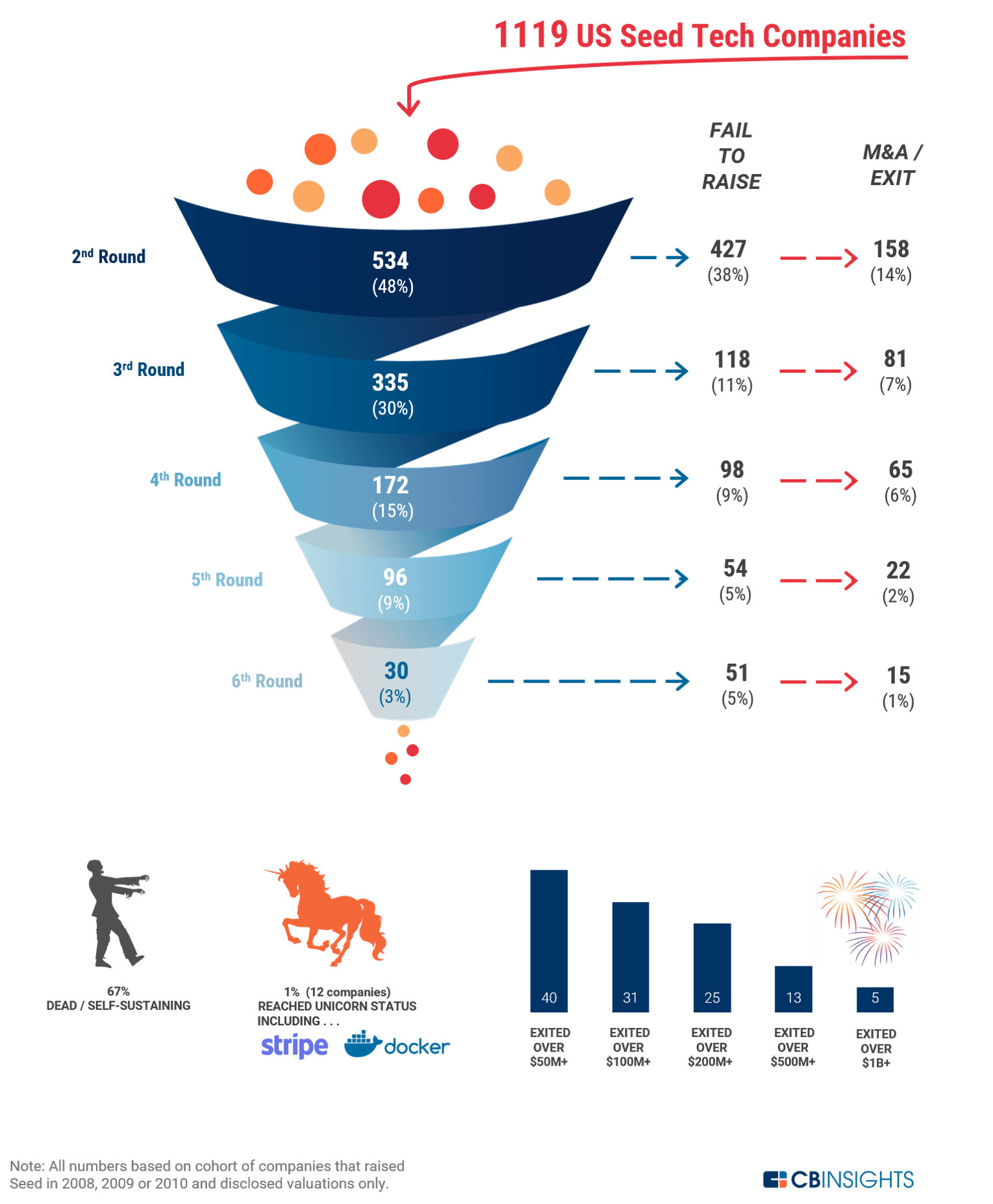

Research from CB Insights show that the chances of a startup hitting a valuation of one billion dollars is less than one percent.

exhibit 5: CB insights

Source: CB Insights

Even if your startup doesn’t become the next unicorn, there is no stopping you from getting a strong valuation from your investors. After all, why leave money on the table? Here are the seven things to bear in mind the next time you pitch to an investor.

7 Factors That Impact Startup Valuation

Factor 1: Market Size

Whether you are talking to an angel investor or venture capitalist, your business idea will fail if it isn’t in a growing market. Whoever you approach for funding will ask “How big can your company get?”

The larger the market, and the larger the market share you can earn, the higher your valuation, and the more attractive you will be to investors.

In other words, avoid approaching investors if you have a good idea. Investors don’t pay money for good ideas. In the world of investing ‘Ideas are cheap, execution is everything.’

Factor 2: Trends

Global trends often impact entire startup and investor landscapes. One of the largest evolutions can be observed in technology. Think about how the Covid-19 pandemic crushed entire industries that thrived on contact while it allowed others like remote conferencing leader Zoom Video Communications to flourish. In other words, the pandemic propelled a new global trend – the contactless economy.

exhibit 6: Zoom founder Eric Yuan

Source: Zoom

Different generations of startups capture opportunities using different technological waves. The prominent 115% rise in the number of US based unicorns between 2013 and 2015[4] was driven by the current technological wave (Internet/mobile) which has reduced the cost of entry significantly. In the previous technology phase, i.e. the Internet wave 1995-2005, startups such as Amazon required extensive financial resources in order to build up logistics and infrastructure to disrupt the book market. In contrast, smartphone applications can currently be developed and introduced to the market at a much lower price point.

Factor 3: Paying Customers

In a world where everyone loves free, e.g. search engine, email, social networks, etc, investors are not so thrilled. None of the unicorns listed above is a free-to-use service. Each one has paying customers.

Even if a service is free to use doesn’t mean there is no revenue model. A messaging app like WhatsApp doesn’t charge its users, but you can bet your last dime it makes money. It’s just that the monetization model is not apparent to users.

No matter how revolutionary your idea is, it must solve a problem that many are willing to pay for. When you have customers who are willing to hand over cash in exchange for your product or service, that’s when you attract the attention of investors.

Factor 4: Traction Speed

Investor ROI is measured both in terms of amount as well as time. What have you accomplished since the company was founded, or even since the last 12 -1 8 months?

These are questions investors ask to evaluate how fast they can get back their money. They want to invest in a team that can make things happen. At the risk of repeating ourselves, ‘Ideas are cheap, execution is everything.’

Factor 5: Team

One of the most common mistakes tech founders make it to focus only on the product to the exclusion of other skills needed for a startup to succeed. They hire for competencies to produce the product without understanding that the product is seldom what makes a startup successful or investible.

A business often requires a range of skills not found in one person. Think of famous startup tag teams:

- Apple: Steve Jobs (Marketing) and Steve Wozniak (Technology);

- Microsoft: Bill Gates (Sales, business development, coding) and Paul Allen (Branding, licensing, coding);

- Larry Page (Product) and Sergey Brin (Technology);

- HP: Bill Hewlett (Engineering) and Dave Packard (Leadership. Invented the ‘HP Way’ of doing business); and

- Alibaba: 18 co-founders led by Jack Ma (Leadership. A former English teacher. Doesn’t know how to code).

Factor 6: Profitability

Even if your market size is big enough, it doesn’t mean your business or product will be profitable. Business is a game of margins, not volume. If you are struggling with competition, investors will hesitate. Too much competition will harm your cash flow and as a result, your business valuation.

While the market may have paying customers, the question is ‘Why should they choose you and not the competition?’ Do you have the business traction numbers to back up your value proposition?

I find that many entrepreneurs can tell me about a product’s price, but few have a ready answer when I ask them about profitability.

Factor 7: Previous Valuation

Here’s a little known but very expensive tip. Hiring the wrong business valuer can doom your startup. We have turned away more than one startup who approached us for fundraising help. Their previous business valuer had promised them a rich valuation to land the engagement. Unfortunately, the valuation was priced so far above market levels that the startup was no longer attractive. Investors decided they couldn’t make a decent ROI if they invested.

The startup found itself stuck between a rock and hard place as it had a paper value that could not translate into funding. In this case, a high valuation turned out to be a wrong answer.

Startup Advisory Services

If you have read this far, tell us ‘Have you found the answers you are looking for?’ If not, please feel free read more about how VALLARIS helps businesses or investors:

Deal Advisory

- Business Valuation

- Financial Due Diligence

- Financial Instrument Valuation

- Financial Modelling & Audit

- Intangible Asset Valuation

- Portfolio Company Investment Valuation

- Share-based Payment Valuation

Foundation

Most businesses falter not because they are uncertain what to do, but because they are uncertain what to do next. If this is a question you would like answered, please contact VALLARIS to start a conversation.

Who does VALLARIS advise?

VALLARIS advises ‘TREND 1010’ businesses: This means you:

- Are a business that’s captured a rising trend (‘TREND’);

- Achieved no less than $10 million revenue in the last twelve months (’10’); and

- Aim to complete a deal or resolve a dispute worth at least than $10 million (’10’).

If that describes you, please contact us to start a conversation.

[1] Yahoo Finance

[2] https://www.straitstimes.com/business/companies-markets/grabs-nasdaq-debut-to-test-its-us40-billion-valuation-set-roadmap-for

[3] https://www.straitstimes.com/business/companies-markets/singapore-start-up-patsnap-turns-unicorn-with-backing-from-softbank

[4] https://techcrunch.com/2015/07/18/welcome-to-the-unicorn-club-2015-learning-from-billion-dollar-companies/